Executive Director, Sahara Group, Tope Shonubi has said the energy conglomerate remained resolute in its decision to contribute to the growth and development of South Sudan’s economy through investment in the oil and power sectors of the world’s youngest democracy.

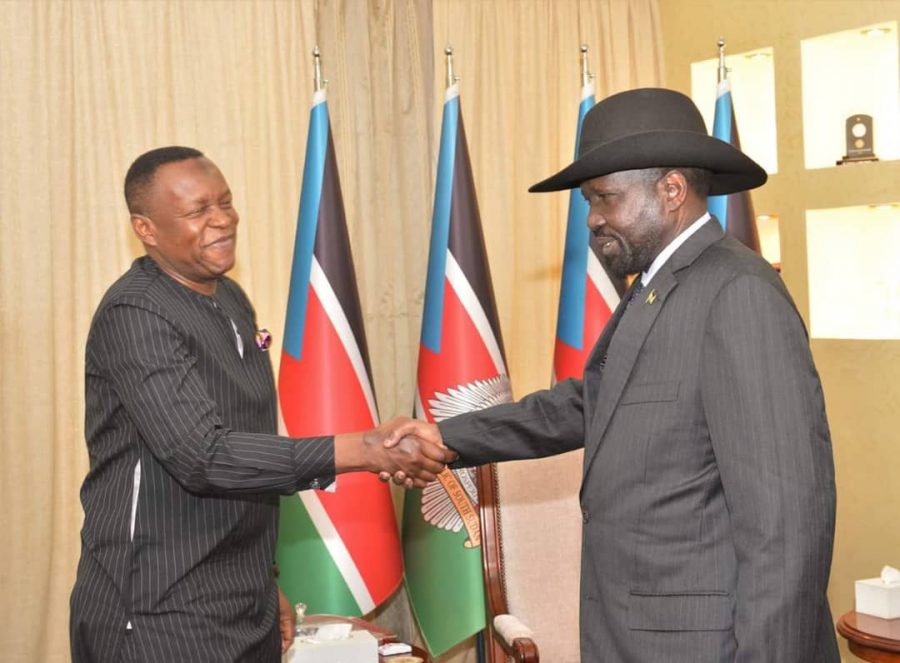

Shonubi who made the assertion during a courtesy call on South Sudan’s President, H.E Salva Kiir Mayardit at the State House yesterday in Juba, said Sahara Group was firmly behind the administration’s policy requiring all local and foreign investors to align with the nation’s good governance protocol in all sectors of the economy.

“Sahara Group has a track record of good governance that is widely acclaimed across various markets where we operate in Africa, Asia, Europe and the Middle East. We are behind full compliance with all governance requirements in South Sudan. In fact, we are here to join hands with the good people of South Sudan under the leadership of President Kiir to ensure sustained economic development in the nation,” he said.

[READ ALSO: Nigeria’s Petroleum minister and Saudi Aramco discuss investment options]

The meeting which was chaired by President Salva Kiir also had the Presidential advisor on Security Affairs, Tut Gatluak, Minister in the Office of the President, Mayiik Ayii Deng, Minister of Petroleum, Awuou Daniel and the Minister of energy Dr Dhieu Mathok in attendance.

The Minister of Petroleum Awuou Daniel commended Sahara Group’s partnership role in South Sudan, noting that Sahara Energy had continued to make good its interest in the energy sector and power plant projects through ongoing investments and collaboration with the ministries in charge of the sectors.

Shonubi said Sahara Group will also contribute to projects designed to enhance sustainable development in South Sudan through the Sahara Foundation which had since upgraded the Computer Centre at the University of Juba with modern equipment.

(READ MORE: Nigeria lacks policy direction under Buhari – Ituah Ighodalo)

Following the intervention, the centre now boasts a better learning ambience, brand new computers, central UPS and server, air conditioners, roof-mounted projector and furniture.

The Computer Center project has set the foundation for other development interventions that Sahara Group is exploring to drive economic empowerment in South Sudan, Shonubi stated.