Almost a week after the President’s directive to the Central Bank of Nigeria (CBN) on the restriction of foreign exchange (FOREX) on food importation, the federal government has shed more light into the policy.

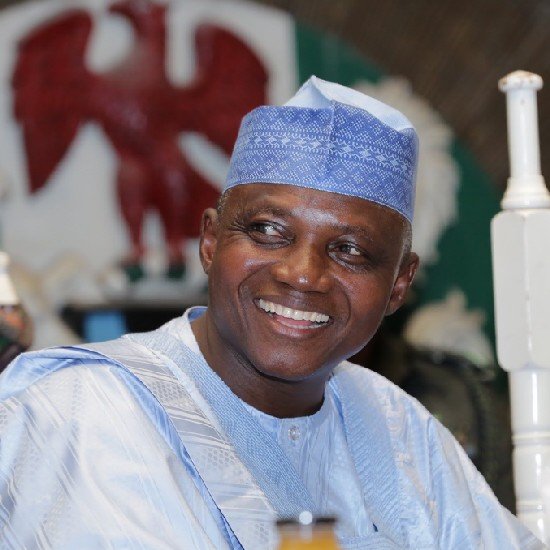

According to the statement credited to the Senior Special Assistant on Media and Publicity, Mallam Garba Shehu, on Sunday, “food importation is not banned and importers can source for their FOREX from other sources”.

[READ MORE: NAFDAC poised to stop rejection of Nigerian food exports abroad]

Criticizing the new policy: Shehu responded to recent controversies that trailed the federal government’s pronouncement on the supposed FOREX ban on food importation. Several analysts have indicated that the proposed ban would heap more misery on the economy.

- Nairametrics explained in its publication following the new policy shift, that the government’s premise for deciding to restrict FOREX on food is faulty. This is due to the fact that Nigeria has not attained full food security and the agricultural sector is still struggling.

- The U.K based newspaper outfit, Financial Times (FT), equally joined in the debate, publishing that President Buhari’s new directive has sparked dismay over policy shift on food imports.

- In its publication, FT stated that instead of inspiring a renaissance of the agricultural sector in Nigeria, the foreign currency import ban would create food shortages, encourage further smuggling, and send prices higher.

Presidency breaks silence: Recall that last week Tuesday, Shehu disclosed that the directive was given to ensure the steady improvement in agricultural production and attainment of full food security. Nigerians have largely raised concerns that while the new ban is ill-timed, some have described the move as an apparent breach of the CBN’s independence.

Meanwhile, Shehu had responded to the article published by FT titled: ‘Muhammadu Buhari sparks dismay over policy shift on food imports’. According to Shehu, the President’s policy still allows importers of the food items to source their FOREX anyhow.

[READ MORE: CBN is no longer independent – Moghalu]

The Presidency’s letter reads: “Your article ‘Muhammadu Buhari sparks dismay over policy shift on food imports’ (15 August) suggests the Nigerian Government is restricting the import of agricultural products into the country. This is simply incorrect. To be absolutely clear, there is no ban – or restriction – on the importation of food items whatsoever.

“President Buhari has consistently worked towards strengthening Nigeria’s own industrial and agricultural base. A recent decision sees the CBN maintain its reserves and put them to use in helping the growth of the domestic industry for those 41 items rather than provide forex for the import of those items from overseas.

“Should importers of these items wish to source their forex from non-government financial institutions (and pay customs duty on those imports – increasing tax-take, something the FT has berated Nigeria for not achieving on many occasions) they are freely able to do so.

“Diversification of forex provision towards the private sector and away from top-heavy government control, a diversification of Nigeria’s industrial base, and an increase in tax receipts – are all policies one might expect the Financial Times to support. Yet for reasons not quite clear, the author and this newspaper seem to believe the president’s administration seeks to control everything – and yet do so via policies that relinquish government control.”

CBN keeps mum: While Nigerians are still concerned about the announcement of the newly proposed FOREX policy by the President, they further questioned CBN’s independence. Until now, Nigeria’s monetary policy authority, the Central Bank has kept mum. Media reports suggest the CBN is expected to address Nigerians today or later in the week, it remains a huge concern why the federal government has suddenly started performing the statutory responsibility of the Central Bank.

[READ MORE: Nigeria partners UNDP and GEF to invest $58m in food security projects]