Nigeria, just like most alcohol drinking countries around the world, is in the middle of a brutal beer war that has seen competing beer makers suffer declining bottom lines in exchange for higher market share.

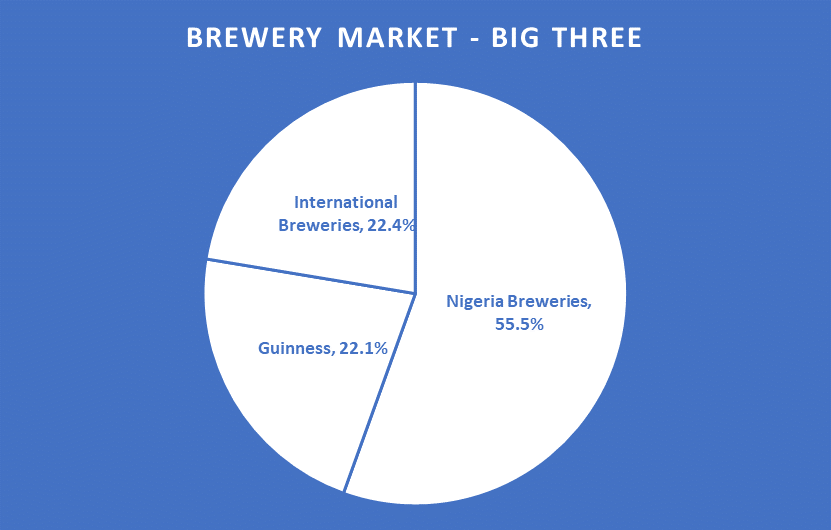

In Nigeria, this battle is currently between three major brewers: International Breweries (owned by AB InBev), Guinness Nigeria (owned by Diageo) and Nigeria Breweries (partly owned by Heineken).

Nairametrics Research

Nairametrics ResearchComparative data from the financial statements of three of the largest beer makers in the country suggest that Guinness Nigeria Plc has lost its place as the second-largest brewery by revenues to International Breweries.

New Number 2: As at the half-year ended December 2018, Guinness Nigeria reported revenues of about N67.79 billion, compared to N70.5 billion in the same period a year earlier. International Breweries, on the other hand, reported half-year revenues for the period ended June 2019 of N68.6 billion, slightly overtaking its rival.

- It is important to note that Guinness reports its full-year results ended June 30th every year, while International breweries adopt a full year-end date of December 31st every year.

- On a quarter on quarter basis, things also looked quite tight. In the quarter ended March 2019, Guinness reported revenues of N33.6 billion compared to International Breweries’ revenues of N33.5 billion.

- In the quarter ended September 2018, Guinness posted revenues of N28 billion compared to International Breweries N30.2 billion

- Also, in the quarter ended December 31, 2018, Guinness and International Breweries reported revenues of N39.7billion and N32.7 billion respectively. Guinness is yet to release its June 30th, 2019, audited results.

- Guinness typically post strong revenues in the quarter between April 1 and June 30th.

- Both companies do not publish their volumes.

Nigeria Breweries still leads both companies, with half-year (January to June 2019) revenues of N170.1 billion.

Bottom line: This is a grand shift in the Nigerian beer market, which has been dominated by Nigeria Breweries and Guinness for decades.

- As competition becomes stiffer, Guinness has lost market share over the last 5 years, especially as younger alcohol drinkers shift towards spirits and cheaper quality beers.

- International Breweries saw the opening and quickly flooded the market with cheap beers such as Hero, Trophy, Castle, Eagle Stout and more recently, Budweiser.

- The company has also improved its distribution capabilities while increasing its capacity over the years.

- Suffice to add that International Breweries also has the strong backing of one of the largest breweries in the world, AB InBev, and is leveraging on its distribution value chain and brand equity.

Huge cost: Winning the second position in market share has had to come at a cost for International Breweries, as detailed in this Nairametrics article. Nevertheless, they will feel vindicated, as Guinness hasn’t had that much upside. In fact, Guinness’ share price has also fallen over the last 5 years, just as it accumulated losses along the way.

What next?: The beer war is not over and more casualties could still emerge. We, however, expect Guinness to fight back, and they may as well recoup their second position when they release their full-year annual report. For now, International Breweries can savour its win.

Thank you for this analysis. It is very helpful indeed.

However, I wish that the companies will publish their sales volumes (quantity sold) in their financials. Information on sales volume will help us know the actual market share of each brewer.

By using the revenue to determine market share, one is assuming that all the beers were sold at the same price. Whereas, in reality, the products were actually sold at different prices. What if International Breweries sold more of Budweiser (premium price), while Guinness sold more of Stout/Harp (cheaper)? Such scenario can produce the kind of market share you showed in your analysis. My point here is that the result in your analysis may not reflect reality, as the true picture will only become clearer when we consider the sales volumes vis-a-vis the revenues.

My view!

To some extent, I agree with @Micheal Onyeweke. Total revenue as the indices for measurement may not reflect “market share” in the real sense of the word. Again, both companies run two different fiscal year reporting. Guinness reports July-June while International Breweries reports January-December. Between the quarters, several variables must have inter-played, By the time Guinness is reporting end/full year, International Breweries is reporting second quarter of a new year and that may not allow for a balanced review. A more rigorous review will actually help this analysis.

What an outstanding post, thank you for climbing this issue.

Being profoundly assured that a lot of people would

share your perspectives, and I showed your writing to a friend of

mine. And that is when the arguments started… We have various opinions but, needless to say, no matter, be it only something routine

or really important, should destroy a true friendship. In my humble view, which surely has the right

to exist, the very purpose you have made cannot be questioned.