PZ Cussons Nigeria Plc has rebranded its Premier Soap brand through the launch of two new variants that are expected to interest consumers. Information gleaned from the company’s social media platforms indicate that the new variants are called – Premier Cool Ultimate Deo Soap, Premier Cool Sports, and Premier Cool Odour Defence.

Each variant is said to possess unique qualities and come in different packs and sizes. More so, the new variants are much more “cooler” than the original, possess antibacterial properties, and can supposedly guarantee 25 hours of protection upon usage. Simply put, the company wants Nigerians to know that “the transition from cool to chill is complete.”

Stay Chilled with the new and improved Premier Cool Ultimate Deo Soap, infused with a greater level of chill. With its increased menthol, and its antibacterial properties, your confidence level is raised to the power of X! #TheChillIsHere pic.twitter.com/HVvwNmyb8P

— Premier Cool Nigeria (@PremierCoolNG) August 5, 2019

[READ: Renmoney’s CEO Boshoro quits, as Chairman steps down]

Coping with competition: Reacting to the re-branding which happened over the weekend, PZ Cussons Nigeria’s Group Brand Activation Officer, Charity Ilevbare-Adeniji, expressed her delight. She also noted that the rebranding process was borne out of the necessity to keep up with the competition whilst offering greater value to the customers.

“We listened to the consumers, we knew what we wanted to change, how we wanted to change it, we knew what competition was offering, we knew we couldn’t just offer soap to the consumers, we knew we needed to offer much more than soap, we needed to offer confidence, lifestyle and everything that goes with it…”

The Chill is finally here!! X marks the chill spot. Don’t be told, go get yours to experience exactly what the chill is #TheChillIsHere #StayChilled pic.twitter.com/FZPRiZjs6V

— Premier Cool Nigeria (@PremierCoolNG) August 5, 2019

Events before now: The development is coming barely weeks after the company’s UK-based parent company hinted at plans to trim down on its Nigerian operations due to poor performance. The company’s overall global profit had declined by 37.5% to £37 million, down from £59.2 million.

The profit decline followed a series of warnings issued by the company to its stakeholders concerning its financials. As Nairametrics reported in December, PZ Cussons UK complained that the unfavourable economic situation in Nigeria was hampering the company’s overall growth potential.

By early 2019, the company once again warned that its financial performance for the full-year 2019 period (which ended in May) will not be very profitable. Again, the unfavourable projection was blamed on the performance of its Nigerian subsidiary which manufactures and distributes a long list of consumer goods such as Imperial Leather Soop, Robb, Carex, etc.

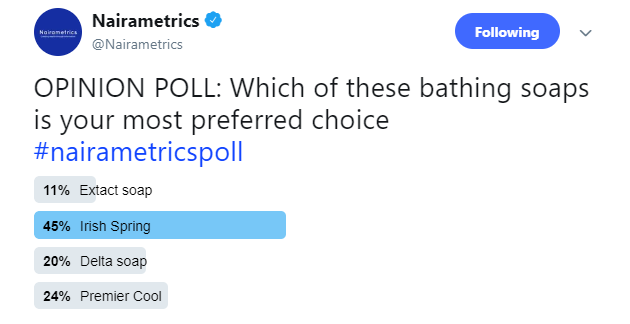

PZ Cussons Nigeria’s soap brands are trying to compete in a saturated market segment where the likes of Irish Spring and Delta Soap are dominating. It is expected that the rebranding will help endear Premier Cool to many young Nigerians who may very well know very little about the product.

The company’s stock closed trading at N6.00 earlier today during the trading session on the Nigerian Stock Exchange.