Lubricants power topline expansion: In the first half of 2019, 11 Plc (MOBIL) recorded a sizeable uptick in top line, with gross revenue coming in at NGN92.81 billion, an 8.02% expansion compared to the same period last year (NGN85.91 billion). Rather than a Q-o-Q drop-off in revenue as witnessed in 2018, the company performed just as well as it did in Q1:2019, posting a 1.43% increase from NGN46.07 billion to NGN46.73 billion.

Reminiscent of Q1, the Lubricants segment was most pivotal to this expansion, growing by 10.11% Q-o-Q, and 9.39% Y-o-Y to mask the -0.53% negative quarterly growth in the fuels segment (from NGN37.53 billion to NGN37.33 billion).

For the whole of H1, Fuels, therefore, contributed NGN74.86 billion (80.66%) to revenue, while Lubes pitched in with NGN17.34 billion (18.69%). The burgeoning Liquefied Petroleum Gas (LPG) segment also sustained its progression, with an 8.64% Q-o-Q improvement, contributing 0.65% (NGN0.61 billion) to the company’s fortunes.

[READ MORE: NNPC clears $833.57 million debt owed to Exxon Mobile’s subsidiary]

2019 has so far pointed out that Liquefied Petroleum Gas is steadily shaping up as a key positive driver for MOBIL’s future, given that no volumes of LPG were dispensed in H1:2018. The company is clearly leveraging its ties with NIPCO to advance the growth of the budding segment.

With deepening cooking gas adoption in Nigeria and a possible PMS price hike before the end of the year, our outlook on the company’s top-line remains upbeat. However, based on the half-year performance, we have erred more towards a conservative stance and moderated 2019FYrevenue growth rate to11.56% (NGN183.63 billion).

Intractable direct costs moderate margins: Up until 2017, MOBIL was the undisputed cost leader in Nigeria’s downstream, with average Cost-to-Sales (CtS) of 85.58%. This status was relinquished in 2018, as NIPCO arrived on the scene, causing an uptick in CtS to 89.92%. The figure worsened in H1:2019, with direct costs reaching 91.88%(NGN85.27 billion) – an 11.37% expansion compared to the NGN76.56 billion recorded in H1:2018. While the company was able to prune operating expenses by 13.45%, the high cost of sales weighed on operating profit, triggering a 17.80% contraction to NGN6.38 billion – a margin of 6.88% (H1:2018: 9.04%). Net Finance costs on overdrafts also came in 167.74% higher, dragging pre-tax profit and net income lower by 23.40% to NGN4.17 billion. Net margin for the half-year, therefore, settled at 4.50%, with an EPS of NGN11.57.

[READ ALSO: ExxonMobil not planning to exit Nigeria – Kachikwu]

Rental income masks operating difficulties: It is quite evident that rent earned from MOBIL’s investments in commercial properties is the adhesive that holds the business together. This detail was even more obvious in the first half of 2019, as rental income contributed a sizeable 63.43% to operating income (vs. 69.44% in H1:2018). Ex-other income from rent, the net margin would have come in substantially lower at 0.13%. Having grown at a CAGR of 38.06% since 2015, we maintain our stance that rental income will remain the key profit driver for 2019FY, even though it is a non-core part of the business.

Higher Payables prop up operating accruals: In the first half, MOBIL’s operating cash-flow improved to NGN8.66 billion (H1:2018: NGN6.68 billion), more than double the net income of NGN4.17 billion, as the company saw a marked increase in trade and other creditors (+90.73%) to NGN15.63 billion.

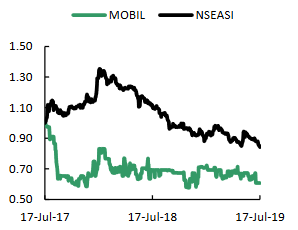

Outlook and Recommendation: After consecutive quarters of dismal earnings, MOBIL now appears to be on a path to recovery. Provided that the expansion in LPG and lubes is sustained, and expected fuel price increases materialize, we now expect a Y-o-Y contraction in net income by only 13.91% (vs. previous expectation of -15.30%) to NGN8.03 billion. 2019FY expected EPS is now NGN22.27, and with a revised target PE of 6.85x, we arrived at a target price of NGN152.56, a downside of 3.44% to the current share price of NGN158.00 and a 9.58% discount to our previous target price of NGN168.73. We maintain a HOLD recommendation.

About Meristem: Meristem Securities Limited is a member of The Nigerian Stock Exchange and is authorized and regulated by the Securities and Exchange Commission to conduct investment banking and financial advisory business in Nigeria. However, the company through its subsidiaries carries out stockbroking, wealth management, trustees and registrars’ businesses which are regulated by the SEC and ICMR.

(READ FURTHER: Mobil targets bigger share of aviation fuel market)