It seems the Transmission Company of Nigeria (TCN) is willing to waive the N270 billion debt owed by Power Distribution Companies (DisCos), as the company has disclosed the condition to erase the debt. DisCos are, however, not willing to budge, as they have their own condition.

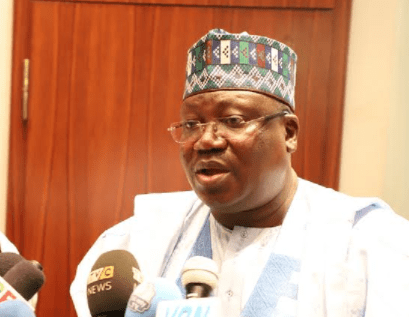

The Managing Director of TCN, Usman Mohammed said wiping the slate clean for DisCos had become crucial as they seemed not to have a solution to their debt problem. Discos became indebted to TCN because their duty is to collect funds from power consumers on behalf of TCN and power-generating companies since they are the middlemen between other sector operators and the consumers of electricity.

[READ ALSO: TCN suspends KEDCO, withholds payment due to it]

The condition for the waiver: To waive the N270 billion debt, the DisCos have been asked to recapitalise. According to Mohammed, this is the only way the DisCos could lift their debt. He stated that the settings needed to be reworked with the government providing 40% while distribution companies are expected to take up 60%.

“So what should we do? This is why we are proposing recapitalisation, where government should bring its own 40% in the distribution companies, while the owners of the DisDos bring their own 60%.

“For TCN, the DisCos are owing us about N270 billion right now. We are ready to forgo that N270bn in as much as we have a market that can work. So we are saying reset the books, remove their debt and make their books clean.”

[READ MORE: DRAMA: TCN declares war on TUC over an attempt to halt power transmission]

Also, the Nigerian Electricity Regulatory Commission (NERC) would be required to tender strong regulation and tariff that would ensure the effectiveness of the recapitalisation exercise.

Why TCN is letting go: The market is collapsing in Mohammed’s view, and the solution to prevent a total collapse is by throwing the DisCos a lifeline such as the debt waiver. It was also necessary to avoid canceling the privatisation scheme which he said would send a wrong signal to the international market.

“If it is cancelled, we will be sending a wrong signal to the international community that Nigeria is not a private sector investment destination.”

Why DisCos owe so much: The privatisation of the power sector took place six years ago under the administration of President Goodluck Jonathan. The administration shared the assets Power Holding Company of Nigeria (PHCN) among six generation companies and eleven distribution companies.

These private distribution companies are said to lack long term investments, so it exposed them to debt, and when banks came knocking, they applied for loans.

Mohammed said, “We (Nigeria) have succeeded in selling our assets to mostly Nigerian investors who do not have the capacity for long- term investment. They don’t have the capacity. Now, Nigerian banks came in and the DisCos went there to collect money.

“These monies were short term in nature, very expensive and not ideal for this kind of investment and this is one of the major problems that we are facing right now in the sector.”

DisCos’ condition: The distributing companies are not interested in TCN’s offer until investors have a blueprint disclosing how their investments in the power sector can be recovered. Until then, it remains uncertain if the DisCos will recapitalise their companies as requested by TCN.

“Recently, there has been a drumbeat for recapitalisation of the DisCos. There are two principal approaches to recapitalisation. We won’t mention the first one today and the other is investment. For the latter to occur, rational investors would need to see a pathway of recovering their investment for them to make the leap.

“It is my hope that the PIP guidelines, if implemented faithfully, efficiently and consistently, will provide this pathway, as necessary to re-orientate the sector towards commercial viability and sustainability,” The Chief Executive Officer, Association of Nigerian Electricity Distrbutors, Azu Obiaya said in defense of the DisCos.

[READ FURTHER: TCN plans to offset loans by having Nigerians pay for it]