Nigerian business magnate, Aliko Dangote, makes about N2.47 billion from cement sales every day. This is according to the Group Managing Director of Dangote Cement Plc, Joseph Makoju, who disclosed that the cement company sells not less than 800,000 bags of cement products to the market daily.

Majoku said the company, which is ranked among 10 top producers of cement in the world, on a daily basis, dispatches “about 40,000 tonnes of cement. Every ton is 20 bags. If you calculate, you will get 800,000 bags. So, we push out 800,000 bags of Dangote Cement every day.”

[READ MORE: Blackstone pulls out of $5 billion pact with Dangote]

Nairametrics understands that since the company sells 800,000 bags of cement every day, and sells 600 bags for N1,510,000, no fewer than N2.47 billion would be recorded as daily revenue for the Dangote Cement.

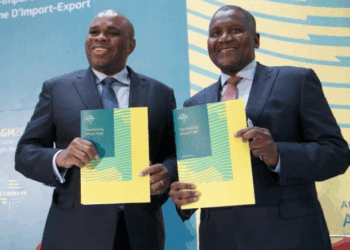

Performance: Dangote Cement Plc appears to be at its best for 2018 fiscal period, as the Chairman of the company was quoted to have said last year was the most successful period in the company’s history. This, however, explains the 52.4% increment of the dividend declared by the company.

Specifically, Dangote cited the 7.4% leap in the group cement sales as the principal factor that informed increase in the proposed dividend. The group cement sales rose to 23.5 million tonnes with a corresponding rise in revenue to N901.2 billion.

The company has consistently declared dividends since it became a quoted company on the Nigerian Stock Exchange with N2, N2.25, N1.25, N3, N7, N6, N8, N8.50, and N10.50 declared for 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016 and 2017 financial years.

[READ ALSO: Dangote Cement Plc’s N50 billion Commercial Paper closes]

About Dangote Cement Plc: The company is a leading cement manufacturing firm headquartered in Lagos, Nigeria with operations in nine other African countries.

The business model entails manufacturing, preparation, import, packaging, and distribution of cement and other related products. It is reputed to be the most capitalised company on the Nigerian Stock Exchange.

Dangote Cement Plc traded N170 in the last trading session of the Nigerian Stock Exchange (NSE).

Absolute nonsense written by a “journalist” who doesn’t bother to check facts.

Firstly, 40,000 tonnes of cement at 20 bags per tonne = 800,000 bags, not 8,000,000, so your calculated figure of N20.13bn is 10x too high.

Secondly, Dangote Cement posted revenues of N901 billion in 2018, an easily checkable fact, and N901bn / 365 days = N2.47bn a day.

Please be more diligent in future.

Dangote cement is a company. A public company in which a shareholder. It would be proper to say Dangote Cement makes 2b daily. Aliko Dangote is also shareholder in that company too.

Nairametric can do better than sensational journalism.