This is the daily market summary brought to you by Zedcrest Capital. As always, the report examines the daily performance of major economic indicators, as well as highlights from trading sessions and key statistics on Treasury Bills, Bonds, etc. This report is dated July 2nd, 2019.

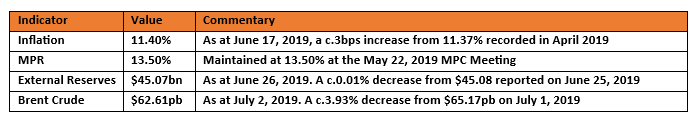

Key Indicators

Bonds: The pace of the recent bullish run in the FGN Bond market slowed yesterday as market players continued to re-invest their bond maturities. We note sustained demand interests on some specific maturities at the short- to mid-end of the curve, most notable the off-the-run 2029 maturity. Average yields remained relatively stable across the bond curve by the close of the trading session.

We maintain our expectation for bond yields to flatten out in the near term, following the resumption in OMO issuance by the CBN.

Treasury Bills: The T-bills market opened the trading session on a cautious note, following the prorated supply from the previous day’s OMO auction. While bids compressed at the short-end of the NTB Curve, supported by buoyant system liquidity, we experienced an upward retracement at the mid- to long-end of the curve as market participants priced in the resumption of OMO auctions by the CBN. Average yields compressed by c.5bps across the NTB curve.

The CBN floated an OMO auction for the second time this week but opted for a ‘No sale’ despite healthy subscription levels.

Despite the no sale, the CBN is still expected to float another OMO auction to manage system liquidity levels in anticipation of last month’s FAAC inflows. We maintain our expectation for an uptrend in yields in the near term.

Money Market: Rates in the money market dipped by c.1.65pct, as the CBN conducted an OMO auction but did not mop up any excess system liquidity from FAAC Inflows due to no sale. The OBB and OVN rates consequently ended the session at 6.57% and 7.21%, with system liquidity now estimated at N474 billion positive.

We expect rates to oscillate in tandem with system liquidity, as we anticipate another OMO auction by the CBN.

FX Market: At the interbank, the Naira/USD rate remained stable at N306.95/$ (spot) and N357.53/$ (SMIS). The NAFEX rate at the I&E window gained by 5k to N360.52/$, as the market turnover saw an increase of 115% to close the session at $303m.

At the parallel market, the cash and transfer rates remained stable at N358.60/$ and N362.50/$ respectively.

Eurobonds: A bit of profit taking activities saw a slowdown in the bullish run of the NIGERIA Sovereigns papers, as investor buzz from the recently concluded G-20 summit fades. We witnessed yields expand by c.7bps on the average across all the papers on the sovereign curve.

The lack of supply of available NIGERIA Corps papers in the street may have caused the slowdown in demand interests in the paper. The Access 21s and Zenith 22s both gained +1pct, while the FIDBAN 22s and ETINL 24s both lost -8pct at the close of the trading session.

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.