Welcome to Nairametrics‘ summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills and Bonds. This is brought to you by Zedcrest.

This report is dated June 7th, 2019.

Key Indicators

Bonds: The Bonds market closed the week on a quiet note, as weak sentiments persist for bonds. Yields expanded by c.02bps across the benchmark bond curve, pushing average yields to close the week at 14.60%.

In the coming week, we expect the market to remain largely order-driven, with local client demand expected to come in to take advantage of the relatively higher yields on the mid- to long-end of the curve above the 14.50% mark.

Treasury Bills: Weakness in the Treasury Bills market was sustained on the last trading session of the week. Yields across the NTB curve expanded by c.5bps on the average. We witnessed some demand at the short end, especially on the August and September maturities.

We expect market activity to oscillate in tandem with the level of liquidity in the Money Market in the near term, as the CBN is expected to float an OMO auction manage excess liquidity from the anticipated OMO maturities. With the release of the third quarter calendar for NTB issuances, we see rates at the primary auctions maintain the downward trend, as the DMO looks to cut down on refinancing costs by issuing more at the 91- & 182-day tenors and less of the 364-days.

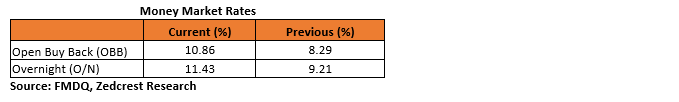

Money Market: OBB and OVN rates closed the week at 10.86% and 11.43% as outflows from the FX Retail auction conducted by the CBN fuel funding pressures. System liquidity is estimated to close the session at N270 billion positive.

We expect rates to remain elevated opening next week, however, OMO Maturities of N125.75bn is expected to moderate rates later in the week.

FX Market: At the Interbank, the Naira/USD rate remained unchanged at N306.95/$ (spot) and N356.92/$ (SMIS). The Naira depreciated by 0.02% stable at the I&E window, to close at N360.75/$.

The Naira continued its gains at the parallel market, as the cash and transfer rates closed the week stronger at N358.50/$ and N362.50/$ respectively.

Eurobonds: A rebound in global oil prices led a rally for NIGERIA Sovereigns papers. We witnessed demand across the sovereign curve, as yields compressed by c.10bps on the average. Demand was most notable at the longer-dated maturities, especially the NIGERIA 2047 and 2049 maturities.

Demand for the NIGERIA Corps continued in today’s trading session, as investors positioned towards the early redemption the Access Bank $400m subordinated notes. The FIDBAN 2022s remain the toast of investors, gaining +13bps on the day.

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.