If you are asked to name the leading food manufacturing companies in Nigeria at the moment, chances are that you will likely list out the biggest, oldest, and quoted ones among them. Perhaps you own some of their shares but haven’t actually reaped the reward of your investment.

One of the reasons is because smaller, more nimble competitors are waging a price war by selling to customers at a price point commensurate with their purchasing power. This is according to a recent report by Coronation Research.

The report suggests the leading players in the value segment are not the very popular NSE-listed companies such as Cadbury, Nestle, Unilever, PZ, Flourmills, Dangote Flour, etc. Instead, the leaders are mostly smaller companies who are surprisingly newer and unlisted on the Nigerian Stock Exchange.

The Coronation published consumer report titled “Power to the Price Points” analysed the Nigerian food and consumer industry. Examples of the companies winning the value market are;

- TG Arla makers of Dano Milk, Dufil makers of Indomie, Belimpex (part of Boulos Enterprises) makers of Softwave tissue paper. They also make Rose Carla, Rose Plus and Rose Family tissue paper.

- Others are Daraju makers of My My toothpaste. They also produce detergent (under the Rana, My My, Soft ‘n’ Clean and Green Antibacterial brands); handwash (under the Liby brand); soap (under the Fressia and Farha brands); and skin care (under the Fressia brand).

- Makers of Sanitary towels Sankin is also on the list.

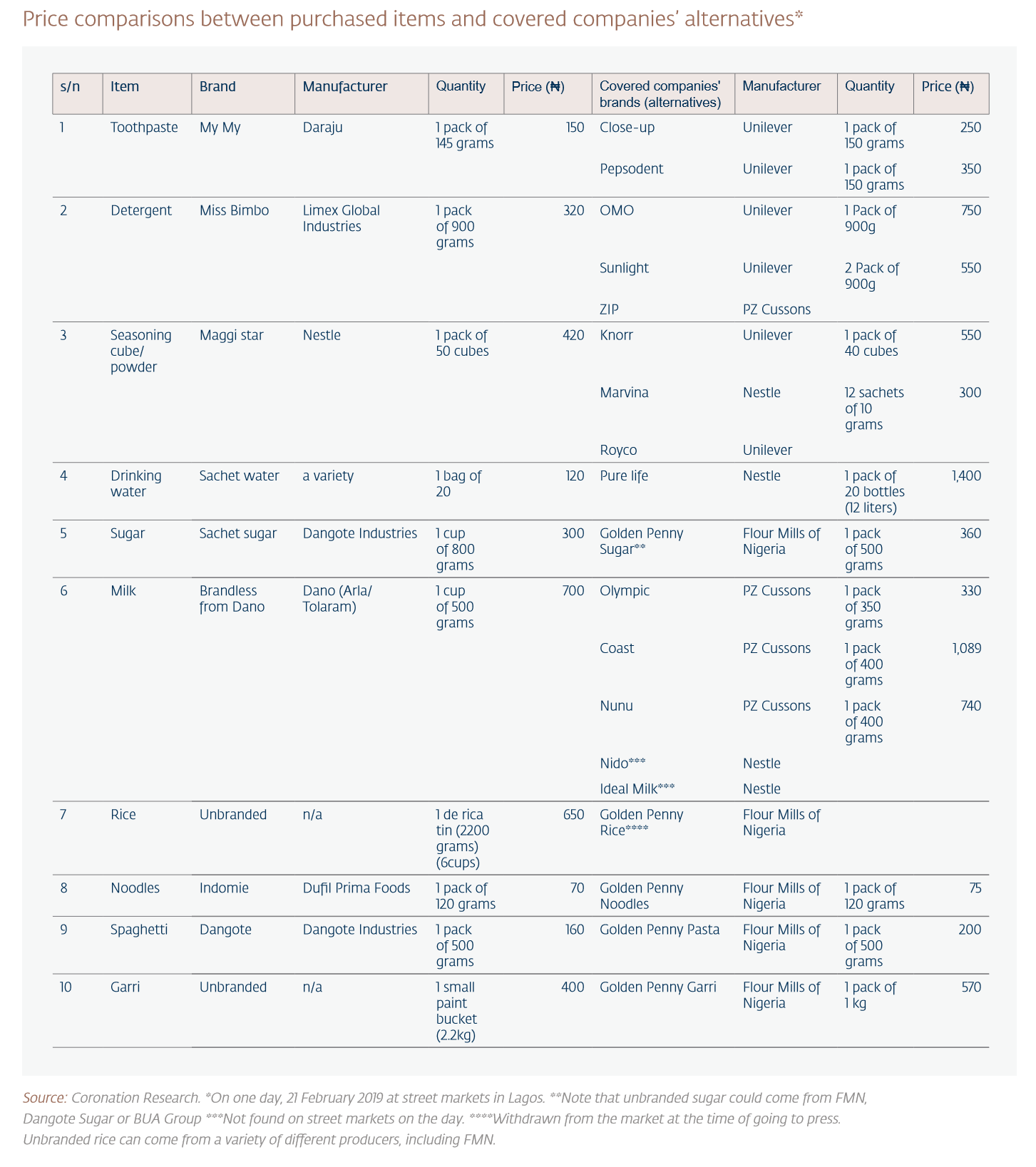

Here is a comparison of prices between the prices of listed brands versus those that are not listed.

Price is the determining factor here. The products manufactured by the unlisted companies were obviously more affordable compared to that of the more established brands which are listed. As a result, they fall within the price point of low-income Nigerian earners, who now make up a large chunk of the population.

Key Takeaway: Investors now have another perspective that can explain why some leading listed consumer brands are not making enough money.

- The Nigerian Stock Market Consumer Goods segment is down 15.7% year to date as investors flee from poor performing stocks.

- Apart from Nestle, most of the other listed consumer goods stocks are performing woefully.

- Rather than throw money into listed companies, investors with deep pockets and keen on owning shares in the consumer goods sector are better off investing in some of these unlisted stocks.

- Those who are not interested will focus on other sector or simply just get out of the stock market in general.

Whilst the report did not indicate such, its revelation suggests dumping stocks in this sector might not be a bad idea.