Oando’s share price fell 9.6% to N4.20 on Friday as news made rounds of an imminent SEC ruling. The stock closed the month 13.4% down and is now the lowest share price (N4.15) since January 2019.

The Security and Exchange Commission, SEC, issued a press release on Friday mandating the Oando’s Group CEO Wale Tinubu and his deputy, Omamofe Boyo to resign from the board of the company citing “serious infractions such as false disclosures, market abuses, misstatements in financial statements, internal control failures, and corporate governance lapses stemming from poor board oversight, irregular approval of directors’ remuneration, unjustified disbursements to directors and management of the company, related party transactions not conducted at arm’s length, amongst others.”

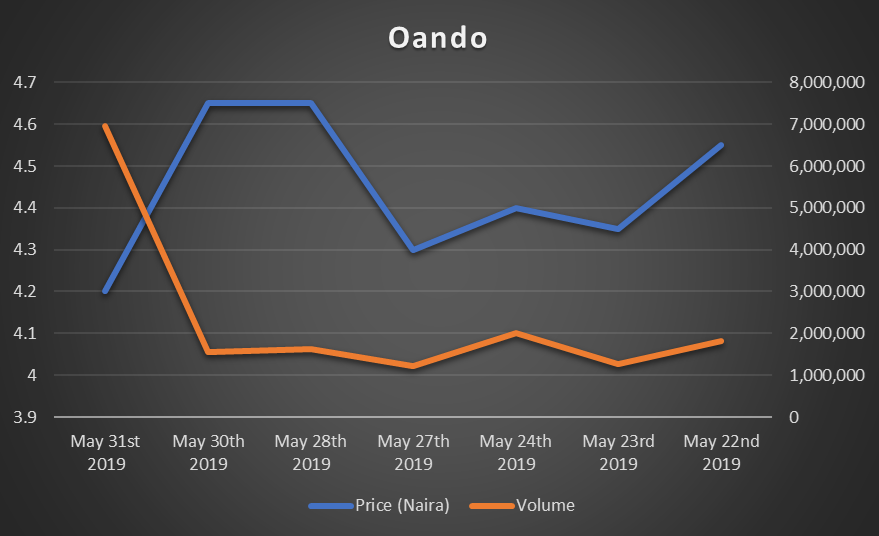

Volume drops: There was also a spike in volume of Oando shares traded on Friday followed by a price drop. It is always a bad signal when there is a price drop alongside a spike volume of shares traded. On the back of Friday’s drop and SEC’s hammer, the company’s share price could continue its price drop by next week.

Market Knows: It is interesting to note that whilst SEC’s press release was published after market hours, Oando’s share price fell 9% at the close of market 2.30pm on Friday. Whilst this may just be a coincidence, it is not unlikely that some investors may have gotten wind of a possible SEC hammer on the directors of Oando.

Oando’s Fundamentals: Oando’s first quarter 2019 results indicated a profit of N4.6 billion up from N4.2 billion a year earlier. The group’s debt profile is also down by 78% from $2.5billion as of December 2014 to $558million. However, Oando is yet to pay dividends since its humongous losses in 2014 but may be on the path to doing so in a couple of years. Oando is currently trading at 1.9x of earnings at a 75% discount to its book value.

Bottom Line: This is not the first time Oando has been in a regulatory squabble. But unlike the past where its fundamentals were bad, Oando has undergone major restructuring in the last 4 years and better positioned to improve. However, there is a growing consensus that its CEO, Wale Tinubu may need to sacrifice himself to allow this company survive all the headwinds it is currently facing. SEC’s latest order is one too many battles for shareholders to bear.