Nairametrics‘ summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills, is brought to you by Zedcrest.

This report is dated May 13th, 2019.

***China Hikes Tariffs on U.S. Products as Trade-War Divide Deepens***

Key Indicators

Bonds: The Bond market opened the week on a relatively note, with yields marginally higher by c.1bp on the day, as demand interests were relatively muted compared to activities in the previous session.

We believe yields have found some support at current levels, given the risk, for stance, on EM assets from the continued US-China trade spat. We consequently expect yields to be relatively stable, with slight profit-taking expected in the near term.

Treasury Bills: The T-bills market remained bullish, despite slight uptick on the short end of the curve. This came on the back of an absence of an OMO auction which caused yields to decline further by c.5bps on the mid to long end of the curve.

We expect yields to remain relatively stable in absence of a renewed OMO auction by the CBN.

Money Market: The OBB and OVN rates spiked higher by c.6pct due to the Wholesale FX auction by the CBN which further drained system liquidity, now estimated at N40bn positive. The OBB and OVN rates consequently ended the session at 16.00% and 16.71% respectively.

We expect rates to remain relatively unchanged tomorrow, as there are no significant inflows anticipated.

FX Market: At the Interbank, the Naira/USD rate decreased marginally by 0.02% to N306.95/$ at the spot market, while the SMIS rate remained unchanged at N356.60/. The NAFEX closing rate in the I&E window declined marginally by 0.01% to N360.83/$, whilst market turnover fell by 55% to $165m. At the parallel market, the cash rate rose by c.0.06% to N359.00/$, while the transfer rate remained unchanged at N363.50/$.

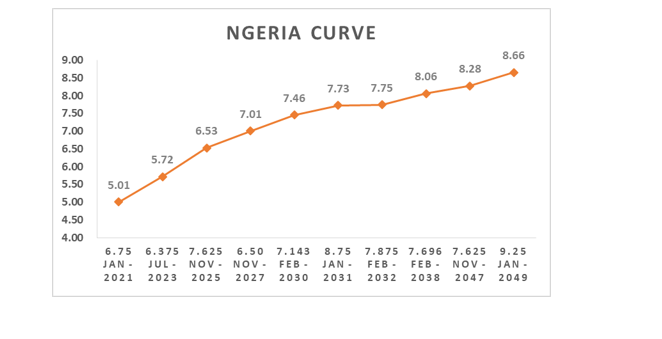

Eurobonds: The NIGERIA Sovereigns turned bearish in today’s session, on the back of the escalated tensions between the US and China, which culminated in retaliatory Tariff measures by the Chinese government. Yields were consequently higher by c.10bps on the day, with the heaviest losses on the 2047s which lost c.1pct on the day.

In the NIGERIA Corps, we witnessed renewed demand interests on the FIDBAN 22s and ETINL 24s and slight gains on the ACCESS, FBNNL, and ECOTRA 21s.

———————————————————————————————–

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

Did they said we have a forex reserve of $44 billion as at this month,now I do not knows whis holding which reserve and by whom ?,i have been reading who they have been tracking our reserve and our parallel forex rates,

Did they includes the reserve holding by various Nigeria financial companies.The cbn said there was expenditure of 100 billion dollar in 2017,where did the money came from ? did it came from foreign investors ? or could it mean the cbn does not includes Nigerian banks holding of forex init’s calculation