Welcome once again to daily performance of major economic indicators and highlights from trading sessions and key statistics such as T-bills, bonds, FX rates, inflation, oil price.

This report is dated May 9th, 2019.

***Buhari Nominates Emefiele for Second Term as CBN Governor***

Key Indicators

Bonds: The Bond market turned firmly bullish in today’s session as market players viewed positively the news of the re-appointment of the CBN governor for another five year term. Expectations for a further decline in OMO stop rates also supported a further decline in yields, which fell by c.9bps on the day. We witnessed the most interest on the 2021s, 2028s and 2037s, with yields breaking the below the 14.50% mark to trade as low as c.14.30%.

We expect demand interests to persist in the near term with expectations for further moderation in short term OMO rates.

Treasury Bills: The T-bills market remained slightly bullish due to the buoyant system liquidity levels in the money market. Demand interests were mostly focused on the longer end of the curve, as market players anticipated a further moderation in OMO stop rates.

The OMO auction remained oversubscribed, with average bid to cover ratio at 2.01. The CBN consequently cut the stop rates by 7bps across all tenors offered, resulting in a total sale of c.N144bn, mostly skewed to the 336-day bill (N112bn).

Money Market: The OBB and OVN rates declined further by c.1pct as system liquidity remained significantly robust due to inflows from OMO maturities and retail FX refunds, which more than offset the OMO auction sale of c.N144bn, with system liquidity now estimated at c.N470bn.

We expect rates to trend slightly higher tomorrow, as market players fund for the bi-weekly retail FX auction by the CBN.

We expect the market to remain slightly bullish tomorrow as market players look to fill lost out bids on the longer tenured offering.

FX Market: At the Interbank, the Naira/USD rate remained unchanged at N307.00/$ (spot) and N356.60/$ (SMIS). The NAFEX closing rate in the I&E window however declined slightly by 0.03% to N361.09/$, as market turnover improved by 78% to $215m. At the parallel market, the cash rate and transfer rate remained unchanged at N359.00/$ and N363.50/$ respectively.

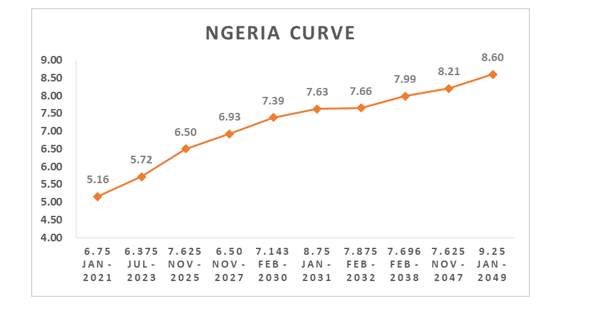

Eurobonds: The NIGERIA Sovereigns remained slightly bearish with yields closing higher by c.7bos on the day. We witnessed the most selloff on the 32s and 47s which lost c.1pct on the day.

The NIGERIA Corps were relatively muted, except for some profit taking witnessed on the UBANL and FIDBAN 22s.

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.