Oando PLC (referred to as “Oando” or the “Group”), Nigeria’s leading indigenous energy group listed on both the Nigerian and Johannesburg Stock Exchange, today announced unaudited results for the three months period ended March 31, 2019.

Commenting on the results Wale Tinubu, Group Chief Executive, Oando PLC said:

“Our results reflect the progress made over the last few quarters and provides an indication of our expectation for the year. Now that our debt profile is down by 78% from $2.5billion as of December 2014 to $558million currently, and our de-leverage program is 90% complete with most of our non-core operations divested for good value, we can now focus on steady growth in our upstream entity. With ICE Brent Crude Oil price currently at a decent level of USD74.48 per barrel, our efforts will be geared towards increasing our production to sustain profitability and position us on the path to resumption of dividend payment to our shareholders.”

Results Highlights

- 11% Production increase, 43,745boe/day compared to 39,556boe/day (Q1 2018)

- 12% Turnover increase, N168.0 billion compared to N150.6 billion (Q1 2018)

- 15% Operating Profit increase, N17.1 billion compared to N14.9 billion (Q1 2018)

- 11% Profit-After-Tax increase, N4.6 billion compared to N4.2 billion (Q1 2018)5% Total

- Group Borrowings decrease, N200.9 billion compared to N210.9 billion (FYE 2018)

Operations Review

Upstream:

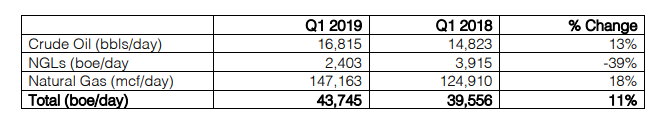

Production for the three months ended 31 March 2019:

During the three months ended March 31, 2019, production increased by 11% at 43,745boe/day, compared with 39,556boe/day in the same period of 2018. Oil production in particular increased by 13% from 14,823bbls/day in Q1 2018 to 16,815bbls/day in Q1 2019, whilst natural gas production increased by 18% from 124,910mcf/day in Q1 2018 to 147,163mcf/day in Q1 2019.

Capital expenditure of $19.3 million (N7.0 billion) was incurred in the three months of 2019

compared to $6.6 million (N2.4 billion) in same period in 2018. This consists of $18.5 million (N6.7 billion) at OMLs 60 to 63, $0.5 million (N180.8 million) at OML 56, and $0.3 million (N108.5 million) on other assets.

Downstream:

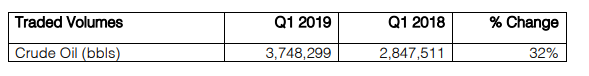

Traded volumes for the three months ended 31 March 2019

In Q1 2019, Oando Trading traded approximately 3.8 million barrels of crude oil under various contracts with the Nigerian National Petroleum Corporation (NNPC) and delivered 103,720 MT of refined products. Our trading business continues to solidify its relationships with leading international and local banks, maintaining sizeable and well diversified structured Trade Finance facilities required to support future growth.

Revenue

Revenue for the period was N168.0 billion, an increase of 12% compared to the same period in 2018 (N150.6 billion) primarily driven by an 11% increase in production, and an 11% growth in traded volumes compared to prior year.

Operating Profit

Operating Profit for the period was N17.1 billion, an increase of 15% compared to the same

period in 2018 (N14.9 billion). This was primarily driven by higher revenue as well as the profit realized on the disposal of our residual interest in Axxela Limited.

Profit-After-Tax

Profit-After-Tax for the period was N4.6 billion, an increase of 11% compared to the same period in 2018 (N4.2 billion). This was primarily driven by a 15% increase in Operating Profit.

Borrowings

Total Group Borrowings for the period stood at N200.9 billion, a 5% decrease from FYE 2018 (N210.9 billion) whilst in our upstream specifically, our borrowings reduced by 8% to $234.3 million compared to $255.6 million in FYE 2018. Since FYE 2014, the Group has reduced its debt by 58% from N473.3 billion while our upstream borrowings have reduced by approximately 71% from $801.6 million in 2014 to $234.3 million (Q1 2019).

Look Ahead

Oil prices have recovered to over $74 per barrel as at the end of April 2019 after reaching a low of just over $50 per barrel at the end of 2018. We expect prices to remain at their current levels in the near term.

As a business, our focus will be largely on driving profitability via growth in our upstream

business and achieving further reduction of borrowings.

In the upstream, we will pursue production growth initiatives through strategic alliances, whilst ensuring operational efficiency and fiscal prudence. We will also continue to work with our partners to achieve cost optimisation on our Joint Venture operations, ensuring the gains from higher revenues are not lost to increasing operating costs.

Our trading business’s primary focus will be geared towards growing our existing market share in Nigeria while leveraging on our relationships with international financiers.

Editor’s Note: This is a sponsored content.