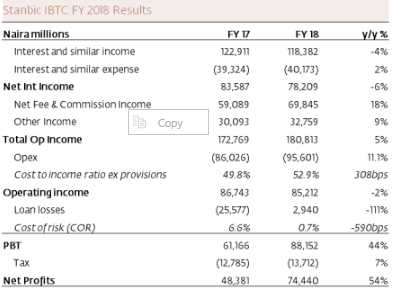

Stanbic IBTC released its FY 2018 results today and, at least in terms of loan growth and Net profits, the report looks stellar. Net profits were up 53.9% y/y, with growth largely driven by Fee & commission income.

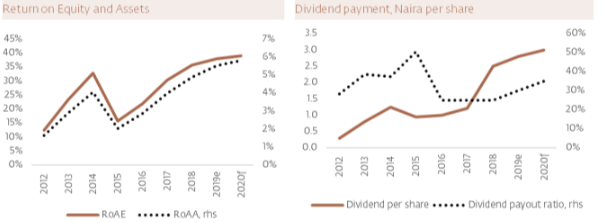

A dividend of N2.50/s was declared, which brings the dividend yield for the year to 3.9% (inclusive of the N1.00/s interim dividend).

We maintain our Buy recommendation with 42% upside potential.

The net interest margin (NIM) declined to 7.8% (2017: 10.5%) and there was a decline of 4% y/y in Net Interest Income due to significant decline in interest from investments (-14.2% y/y) relative to 4.6% growth in interest from loans and advances.

Non-interest revenue was strong; it grew 15.1% y/y, riding on a significant increase in Net fee and commission income (+18% y/y) and trading income (+7.4% y/y). The bank leveraged its electronic banking platform to grow this line item.

The bank was unable to keep operating expenses at bay as its cost-to-income ratio rose by 308bps. The growth in operating expenses (11.1% y/y) was slightly less than average inflation at 12.15%. This was induced by a significant increase in staff costs and AMCON charges.

The Cost of risk fell by 590bps y/y as asset quality improved (beyond our expectations). The loan loss provision decreased by 111.2% y/y due to a N2.9bn write-back from previously-impaired loans. The non-

performing loan (NPL) ratio trended downward from 8.7% in FY 2017 to 4.0% in FY 2018, below the regulatory benchmark of 5%.

Stanbic IBTC’s net loan book was up 16.3% y/y, making it one of the few banks under our coverage to grow loans in FY 2018. Gross loans grew by 14.2% during the year. On the back of this we expect Net interest income to grow this year.

The bank reported 44% growth in Pre-tax profits and 54% growth in Net profits.

From a profitability standpoint, Stanbic IBTC’s 35.7% return on equity for FY 2018 is the company’s highest in six years and the highest in the Nigerian banking industry, at least among the listed banks. Return on Assets also came in strong, at 5.2%.

We have a price target of N66.00/s for Stanbic IBTC and, given the potential upside relative to current price of N46.60/s, we maintain our Buy rating on the stock