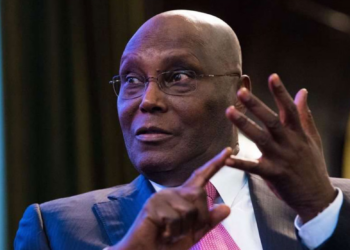

Stocks of Nigerian banks are starting to react to the outcome of the Nigerian election, which saw the incumbent, President Muhammadu Buhari defeat the Presidential Candidate of People’s Democratic Party, Atiku Abubakar.

In a recent report, the Nigerian banking stocks recorded the biggest fall since 2016, after stocks dropped by 4.6 per cent at the end of trading on the floor of the Nigerian Stock Exchange on Thursday.

While stocks dipped, the country’s benchmark stocks index retreated for the third day. Recall that the dramatic and unexpected postponement of Nigeria’s highly-contested presidential election had a ripple effect on the country’s economy.

Nairametrics had reported that while some investors are understandably happy due to considerable appreciation in the values of their interests, others were saddened by the decision of the Electoral body of Nigeria, INEC.

The Affected Banks

On the Nigerian Stock Exchange, an index of Nigeria’s 10 largest banking stocks dropped by 4.6 per cent, with First City Monument Bank Plc, Diamond Bank, Guaranty Trust Bank Plc, Wema Bank, Fidelity Bank Plc, Access Bank Plc, Unity Bank Plc, United Bank for Africa Plc, Stanbic IBTC Holdings Plc, Zenith Bank Plc, FBN Holdings Plc, Ecobank Transnational Incorporated and NPF Microfinance Bank Plc all affected by reaction to post-election.

First City Monument Bank Plc was the sector’s major loser, down by 9.78 per cent. Diamond Bank Plc saw its share price drop by 7.76 per cent, Unity Bank Plc’s share price declined by seven per cent, while Guaranty Trust Bank Plc’s share price dropped by 6.85 per cent.

Fidelity Bank Plc, Wema Bank Plc, Access Bank Plc, United Bank for Africa Plc, Stanbic IBTC Holdings Plc, Zenith Bank Plc, FBN Holdings Plc, Ecobank Transnational Incorporated and NPF Microfinance Bank Plc recorded share price declines of 6.38 per cent, 5.13 per cent, five per cent, 4.49 per cent, 4.23 per cent, 4.02 per cent, 1.92 per cent, 1.41 per cent and 1.23 per cent.

Post-election reaction

The fall in the Nigerian banking stocks was the most since June 2016 a day after the re-election of President Muhammadu Buhari. This makes it the second time stocks will react to the victory of President Buhari.

According to analysts, the defeat of former Vice President of Nigeria, Atiku Abubakar played a major role in the slump of Bank stocks, as investors are said to favour him ahead of the President-elect.

Atiku is considered the market-friendly opponent, and with his rejection of election result, investors are skeptical with the outcome of the election, unsure of the economic policies of President Buhari.

Recall the President took six months before naming his cabinet when he was elected in 2015.

“We are seeing investors react negatively in the short term to the election results.

“Buhari easily won a second term as president of Africa’s biggest oil producer with promises to revive an anaemic economy and tackle security threats, including a devastating insurgency by Islamic State.

“His main opponent, Atiku Abubakar, who was seen as favoured by investors, has rejected the results of the weekend vote.” An analyst at Exotix Capital, Olabisi Ayodeji, said in an interview with Bloomberg