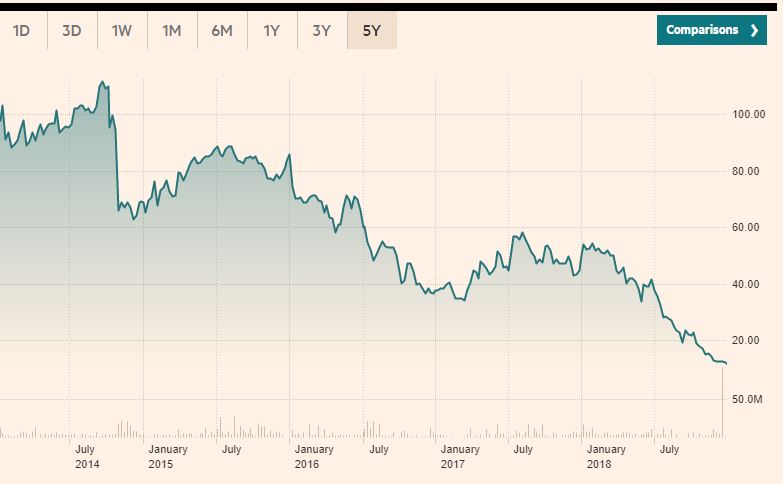

Cement giant, Lafarge Africa, hit a 5–year low of N11.50 in yesterday’s trading session on the Nigerian Stock Exchange. The stock opened at N12 and closed at N11.50, down N0.50 or 4.17%.

Year to date, the stock is down 7.6%, underperforming the All Share Index which is down 2.11%.

Why the decline?

Large cap stocks have borne the brunt of a bearish market, as retail investors sell their holdings to meet key bills.

Investors may also have taken negative sentiments on the stock, in view of the ongoing rights issue which would lead to a dilution of their shareholdings.

Company-specific factors

The company will be raising N89.2 billion through the issue of 6 new shares for every 7 shares held by shareholders as at 4th December 2018. A total of 7,434,367,256 shares will thus be issued at ₦12 per share.

The offer opened on Monday, 17th December 2018 and will close on Wednesday, 23rd January 2019. Proceeds will be used to pay down the company’s debt.

This would increase the stock’s outstanding shares by 53% to 16 billion. The increased volume would also lead to lower earnings per share.

The rights issue is the second in two years. In November 2017, the company raised N131 billion through a rights issue. Proceeds were used to repay a loan taken from its parent company.

Savvy investors may also have decided to sell off their holdings, once the rights issue was announced, with intentions of entering at a much lower price.

How low will it go?

FY 2018 results would be a key determinant of the stock’s direction. Results for the half year ended June 2018 show that profit after tax fell sharply from N19.7 billion recorded in H1 2017 to N3.9 billion in H1 2018.

Q3 2018 results were much worse, with the company recording a loss after tax of N10.3 billion.

An almost inevitable poor FY 18 result could lead to the stock tanking much further.