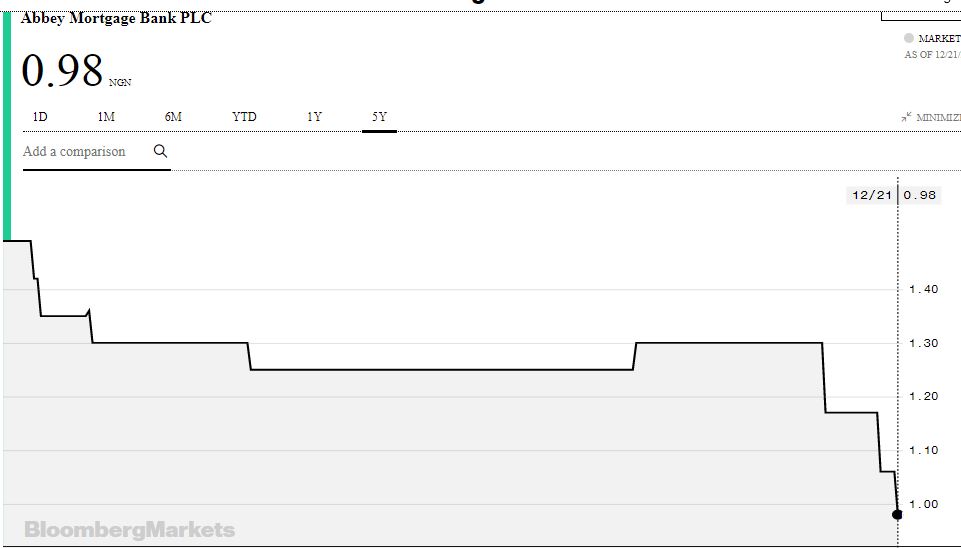

Abbey Mortgage Bank (formerly known as Abbey Building Society) last week hit a 5-year low of N0.98. Year to date, the stock is down 24.62%.

For investors who have held on to the stock in the last 5 years, the losses are much more. Holding the stock from 2014 (when it was trading at N1.49) till last week, would have resulted in a loss of 34.62%.

About the company

The bank was incorporated in Nigeria as a private limited liability company on 26 August 1991 and obtained its license to operate as a mortgage bank on 20 January 1992. It commenced business on 11 March 1992 and later converted to a public limited liability company in September 2007.

On 21 October 2008, the bank became officially listed on the Nigerian Stock Exchange. On 16 January 2014, it changed its name from Abbey Building Society Plc to Abbey Mortgage Bank Plc.

Is the Abbey falling?

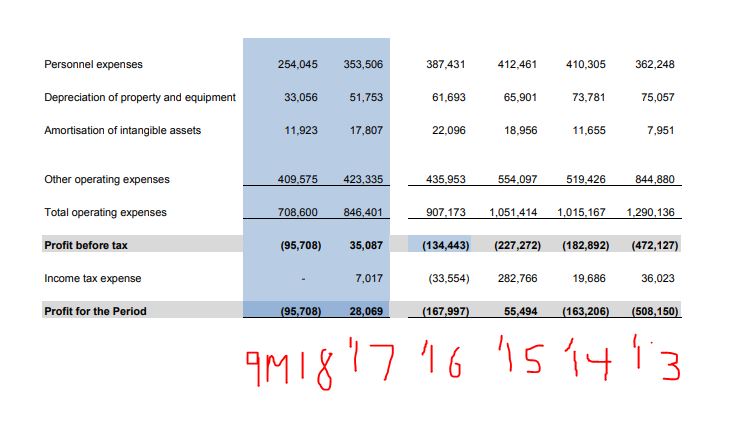

Results for the nine months ended September 30, 2018, show that gross earnings fell from N1 billion in 2017 to N982 million in 2018. The firm made a loss before tax of N95.7 million in 2018, as against a profit before tax of N61.6 million made in the corresponding period of 2017.

This could be an indication that Abbey Mortgage Bank could record a loss for the 2018 financial year.

Expenses are a pressure point

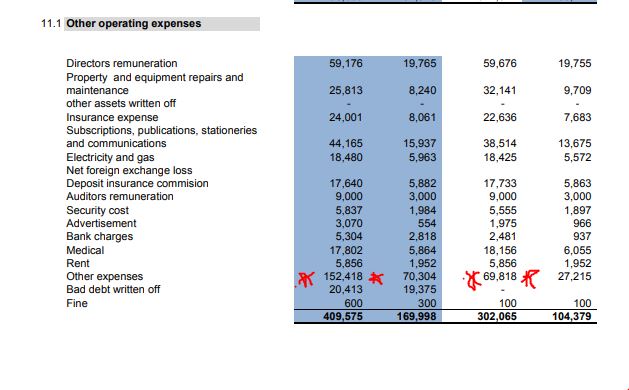

The loss recorded was largely due to operating expenses.

While the firm had net operating revenue of N612 million, total operating expenses amounted to N708 million. Personnel expenses amounted to N254 million, while other operating expenses incurred equalled N409 million.

The other expenses segment had the largest increase jumping from N69.8 million in 2017 to N152 million in 2018. The company, however, provided no explanation for this.

Back to the red

Abbey Mortgage Bank has struggled in the last half a decade. From 2013 to 2016, the firm recorded losses even though they declined year on year, before recording a profit before tax of N35 million in 2017.

Nothing for shareholders

Negative retained earnings of N279 million as at 2018 mean that the firm may not be paying dividends to shareholders. It also paid no dividends for the 2017 financial year.