Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

- Investors look to Secondary Market to fill unmet demand at previous day’s auction

- CBN conducts Special OMO Auction to mop up OMO maturities

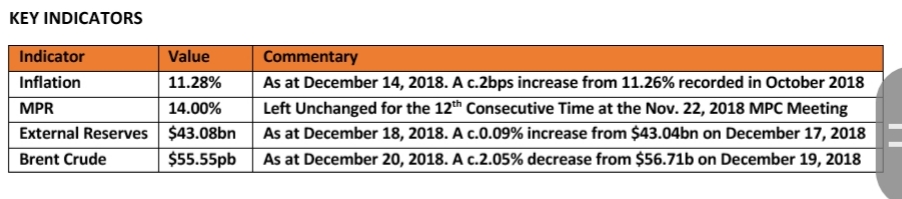

KEY INDICATORS

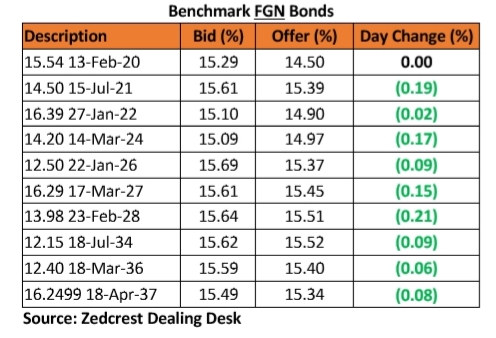

Bonds

The FGN Bond market reacted positively to the low volumes sold at the previous day’s Bond auction. Yields compressed by c.11bps on the average across the Bond curve, as participants adjusted to accommodate the expected demand. We witnessed demand at the mid-end of the curve, especially the 2027s and 2028s maturities, which saw yields compress by c.18bps in that space.

We expect the bullish sentiments to remain short-lived as investor demand at current yield levels remains weak. Deteriorating economic indicators (e.g. unemployment) as well as weak outlook for global oil prices continue to support our bearish outlook for bonds for the rest of the year.

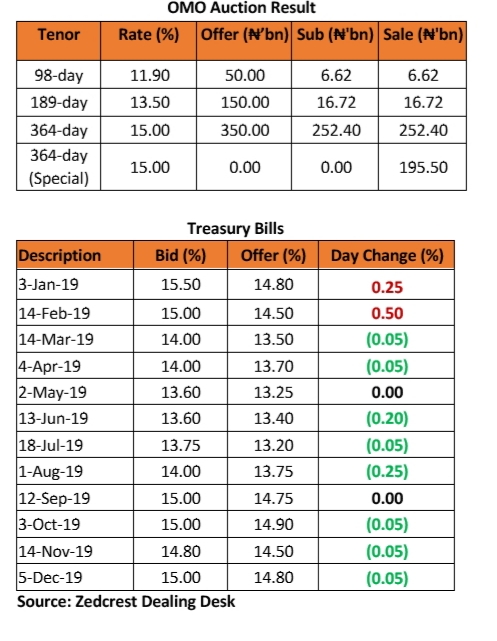

Treasury Bills

The T-bills market saw some reprieve as NTB & OMO maturities of N497.81bn hit the system. Yields across the mid- to long-end of the Benchmark NTB curve compressed by c.8bps on the average following slight investor demand on those maturities. The short-end however remained bearish, with yields expanding by c.23bps on the average at the end of the NTB curve.

The CBN consequently rolled over c.95% of the total amount of maturing OMO bills at today’s OMO auction, maintaining rates across the tenors on offer. The CBN sold a total of c.N471.24 across the three maturities on offer, including special OMO sales of N195.50bn.

We expect yields to remain elevated to close the week as market liquidity shrinks from expected outflows.

Money Market

Money Market rates closed lower on the day, despite liquidity mop up by the CBN via the sale of OMO securities (c.N471.24bn). Open Buy-Back (OBB) and overnight (O/N) dropped to 13.58% (from 21.71%) and 14.83% (from 23.07%) respectively due to OMO maturities of c.N497.81bn. Consequently, System Liquidity is estimated to close in a negative territory of c.N52bn.

We expect rates to close the week higher as market participants provide funding for FX Retail interventions by the CBN.

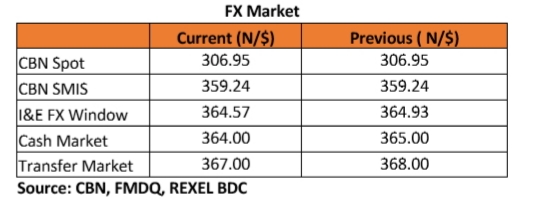

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N306.95/$ (spot) and N359.24/$ (SMIS), while the NAFEX rate in the I&E window appreciated marginally by c.0.10% to N364.57/$ from N364.93/$ previously. Value traded at the I&E FX window increased by c.21% day-on-day, with a total trade turnover of $319.96mm traded in 468 deals, with rates ranging between N362.50/$ – N367.00/$.

At the parallel market, the cash and transfer rates appreciated by c.0.27% to close at N364.00/$ and N367.00/$ respectively.

Eurobonds

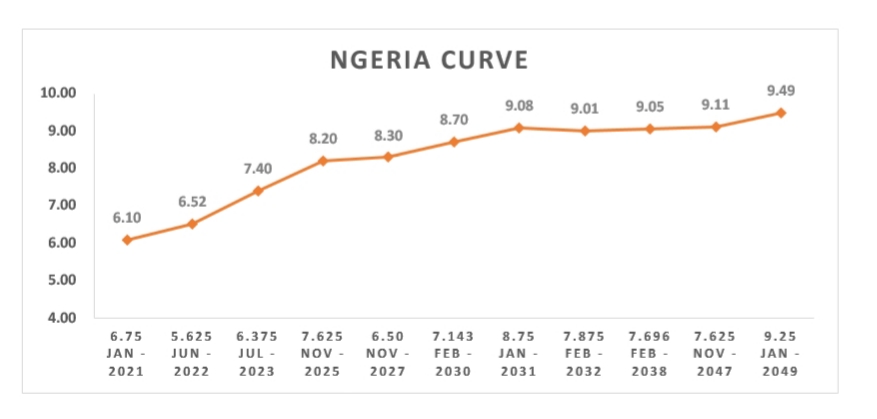

The NGERIA Sovereigns continued its bearish run, with yields ticking further higher by c.4bps on the average across the curve, in light of pressures from lower global oil prices and a rate hike by the US FOMC yesterday.

It was a quiet trading session on the day for the NGERIA Corps, especially on the Diambk 19s as further details emerge of the proposed merger of Access and Diamond Banks. Sellers remained on the ACCESS 21s Subs, as yields on that paper expanded further by c.7bps from the previous close.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.