Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

- DMO’s Weak Borrowing Appetite Forces 10-yr Auction rate 33bps lower

- Buhari Proposes N8.83trn Budget for 2019

KEY INDICATORS

Bonds

The FGN Bond market remained flat in today’s session, as market players sought for higher yields at the bond auction by the DMO. In line with our expectations, bids remained weak on the 2023 and 2025 bonds with rates clearing c.5bps higher at 15.25% on the 2023s whilst they remained unchanged at 15.50% on the 2025s.

The 2028s which however enjoyed the most interest of c.N83bn, was significantly undercut by the DMO, with a paltry sum of N1.29bn sold of the N35bn offered and with rates clearing significantly lower (-33bps) at 15.50%. The Auction was consequently unsuccessful having recorded a miniature average bid to cover ratio of 0.06X.

We expect market players to remain relatively risk off in anticipation of higher funding requirements in the coming month.

Treasury Bills

The T-bills market remained slightly bearish in today’s session as the CBN intervened further with a c.N53bn OMO sale, while system liquidity opened the day in Negative territory. Yields were higher by c.5bps on the day, with most selloffs seen on the short end of the curve, whereas there were slight interest on some mid and long tenors.

We expect yields to remain elevated but with some bargain hunting expected on the short end of the curve given expectations for c.N492bn in OMO and PMA repayments tomorrow. The Long end of the curve should however become slightly pressured, with the CBN expected to intervene with a 364 day offering.

Money Market

Rates in the money market remained relatively stable, with the OBB and OVN rates closing the day at 21.71% and 23.07% rates. System liquidity which opened the day in Negative territory is however estimated to decline further to c.N86bn negative, due to the OMO sale by the CBN.

We expect rates to moderate slightly tomorrow, due to c.N492bn inflows expected from OMO and PMA maturities. The CBN is however expected to maintain its aggressive stance on systemic liquidity, with rates expected to significantly worsen toward weekend.

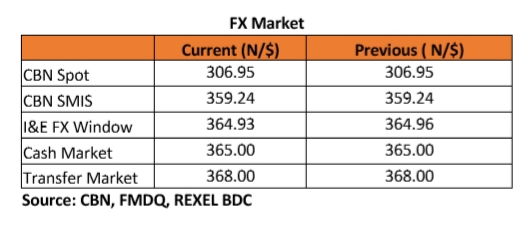

FX Market

At the Interbank, the Naira/USD rate remained unchanged at N306.95/$ (spot) and N359.24/$ (SMIS), while the NAFEX rate in the I&E window appreciated marginally by to N364.93/$ from N364.96/$ previously. At the parallel market, the cash and transfer rates remained unchanged at N365.00/$ and N368.00/$ respectively.

Eurobonds

The NGERIA Sovereigns remained bearish, with yields ticking further higher by c.5bps, as market players reacted to the plunge in oil prices and expectation for a rate hike today by the FOMC.

In the NGERIA Corps, the Diambk 19s receded by c.50ppts from its previous day highs, now 96/97. We witnessed continued interests on the FBNNL 21s and Zenith 22s, while investors sold off on the Access 21s Snr.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.