Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as T-bills, bonds, FX rates, inflation, oil price.

- Diamond Bank Eurobond Rallies 800bps Following Merger Announcement

- CBN spends $11bn on forex this year

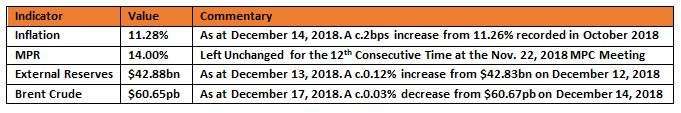

KEY INDICATORS Bonds

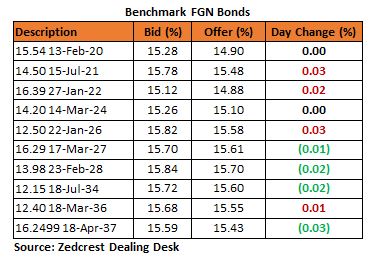

Bonds

The FGN Bond market opened the week on a relatively flat note, with only slight interests seen on the 2028 and 2037 bonds, while yields remained unchanged on the day.

We expect yields to tick slightly higher mostly on the short and mid tenors in the build up to the FGN bond auction scheduled to hold on Wednesday.

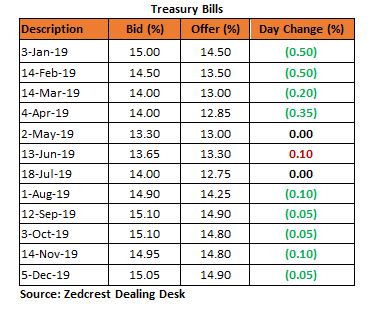

Treasury Bills

The T-bills market opened the week on a relatively flat note, with yields relatively unchanged on the day. This was as the CBN maintained its OMO intervention in the market, with a total sale of c.N20bn of the N150bn offered and with rates maintained across tenors. We however observed slight buying interests on some short and mid tenors as some market players took positions in anticipation of some client demand from the forthcoming PMA maturities (c.N25bn) to be fully repaid by the DMO.

We expect yields to remain elevated as the CBN is expected to maintain its spate of OMO interventions, which would put further pressure on system liquidity.

Money Market

Rates in the money market opened the week higher, with the OBB and OVN rates closing the day at 36.67% and 38.58% respectively. This was as the CBN maintained its OMO and wholesale FX interventions in the Interbank. System liquidity is consequently estimated at c.N80bn negative from a positive level of c.N21bn opening the day.

We expect rates to remain elevated, with the CBN expected to maintain its pace of OMO issuance ahead of the c.N472bn in OMO maturities on Thursday.

FX Market

At the Interbank, the Naira/USD spot rate depreciated by c.0.02% to at N306.95/$, while the SMIS rate remained unchanged at N359.24/$ (SMIS). At the I&E FX window, the NAFEX closing rate appreciated marginally by c.0.01% to close at N365.18/$ from N365.23/$ previously.

At the parallel market, the cash and transfer rate depreciated by 0.55% and 0.27% to N365.00/$ and N367.00/$ respectively.

Eurobonds

The NGERIA Sovereigns opened the week on a slightly weaker note, with yields trending higher by c.6bps on average. We witnessed continued retracement from a recent uptrend mostly on the mid to long end of the curve, as investors price in expectations for a rate hike by the US FED at its 19th Dec FOMC meeting.

In the NGERIA Corps, today was the DIAMBK story with yields on the DIAMBK 19s gaining a whooping 800bps on the day, following announcement of a merger deal with ACCESS Bank Plc, which consequently doused fears of debt default on the bond maturing in five months. There were however slight sell on the ACCESS senior and subordinated 2021 bonds.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.