Last week was a negative one on the Nigerian Stock Exchange, as the All Share Index closed at 30,672.79, down 194.03 basis points or 0.63%. Year to date, the index is down by 19.80%. Stock performance has been varied. While some stocks are still trading close to their year highs (and in some cases 5-year highs), others have hit a year low and some, a 5-year low.

The following stocks hit a 5-year low in last week’s trading.

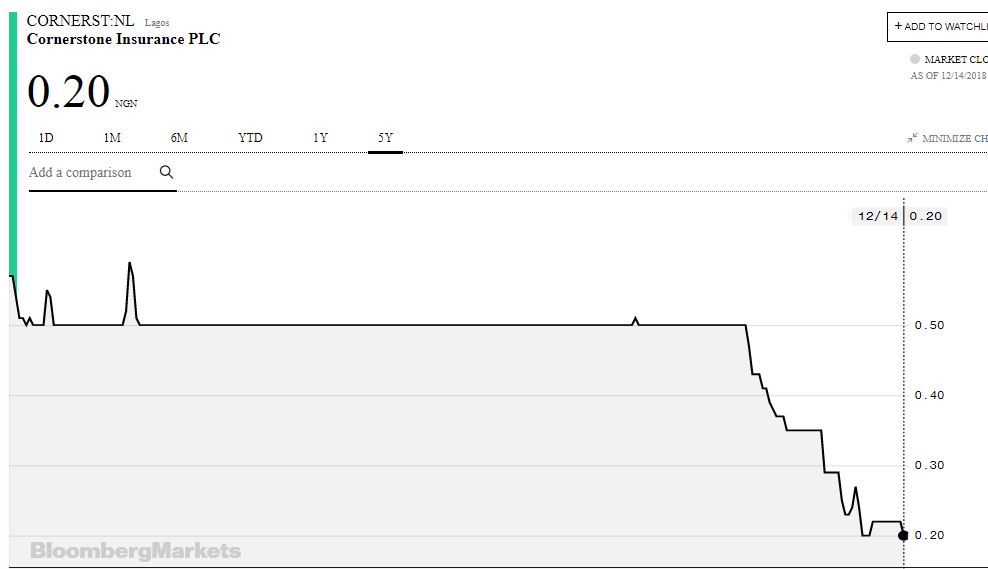

Cornerstone Insurance Plc

Cornerstone Insurance hit a 5-year low of N0.20 per share in Friday’s trading session. Year to date, the stock is down 60%. Investors that have held the stock in the last years have slightly bigger losses at 64.9%.

Why has the stock done so poorly?

The decline in the stock’s price over the last few years may be closely connected to its poor performance. The company has not paid dividends in over three years, and recorded losses after tax of N1.7 billion in 2016 and N3.3 billion in the 2017 financial year. Its poor performance had caused Nairametrics to classify it as a Zombie insurance stock for investors to avoid.

2018 may however be a turn around year, going by its results for the nine months ended September 2018. The firm made a profit after tax of N658 million, as against a loss after tax of N2.1 billion recorded in the comparative period of 2017. Barring any large claims, Cornerstone Insurance could thus make a full year profit in 2018.

Investors expecting dividend payments may have to wait a while, as the company currently has negative retained earnings and is barred from paying dividends till these are wiped.

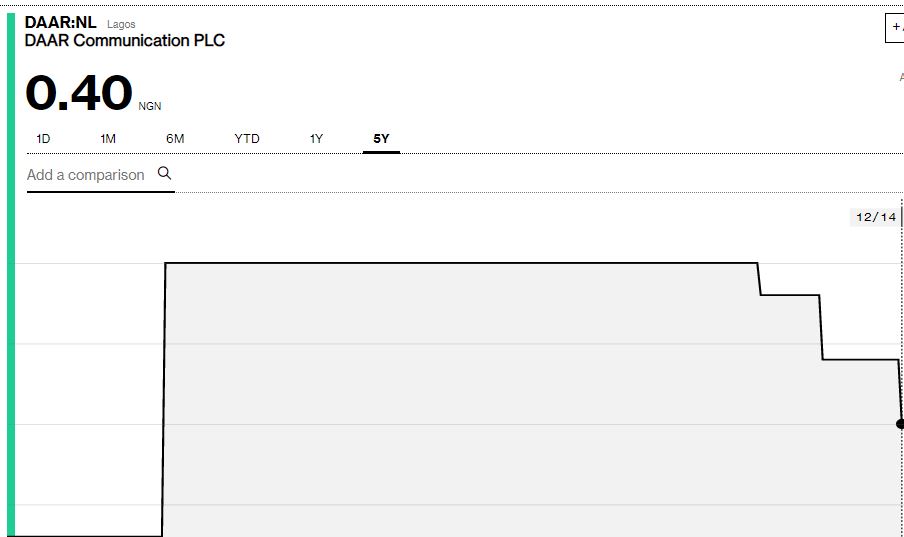

Daar Communications Plc

Daar Communications Plc hit a 5-year low of N0.40 per share in last Thursday’s trading session on the Nigerian Stock Exchange. Year to date, the stock is down 20%. Investors that have held the stock in the last 5 years have nothing to cheer about, as it has declined by 20%.

For investors that bought the stock during its Initial Public Offer in 2008 at N5 per share, and have held, they would have suffered a 92% loss in value.

Why has the stock done poorly?

Daar has recorded losses over the past few years, and 2018 may be no different, even though the magnitude of losses has reduced. Results for the nine months ended September 30, 2018 show that revenue increased from N2.5 billion in 2017 to N3.3 billion in 2018. The firm however recorded a loss after tax of N320 million in 2018, as against N2 billion in 2017.

Daar had, in a statement released to the NSE, announced that it had embarked on some staff restructuring and business rejigging. The company also promised to hold its 2017 and 2018 AGMs in the first quarter of 2019.

Full year 2018 results should provide some more clarity on how well its turnaround efforts have yielded fruits. Till then, the stock could continue sliding to the N0.20 mark.