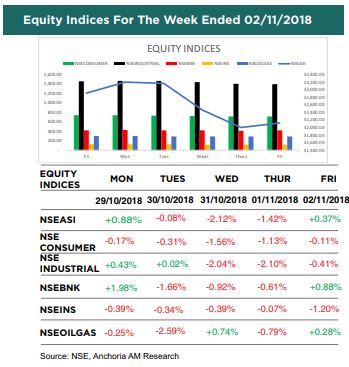

The performance of the Nigerian Equity Market returned bearish last week with the index (NSE ASI) down by 2.38% WTD to close at an index level of 32,124.94 and Market capitalization of N11.73 trillion.

The sectoral performance was negative as bearish sentiments were witnessed in all sectors, the Oil & Gas sector recorded the highest decrease amongst NSE indices with the NSE Industrial index down by 4.06% WTD, owing to significant price depreciation in CCNN (-18.84%).

The market activities were characterised by profit taking on 3 out of 5 trading sessions due to increased sell offs on some stocks in all the sectors. This is due to unimpressive quarterly report and risk ahead of 2019 General Elections.

In the global space, all selected equities markets halted the bearish trend as demand increased due to developments around the US-China trade war as Trump’s administration is set to draft trade accords with China ahead of the Mid term elections on 06 November 2018. Other factors include: Low prices of stocks as some market are considered to be oversold, and strong economic data.

Stock Watch

Over the last five trading sessions:

SEPLAT (Seplat Petroleum Dev. Company) fell by 3.09% to

close at N625.00.

Recommendation: We maintain a hold

rating on this stock.

FBNH (First Bank of Nigeria Holdings) fell by 15.00% to close

at N7.65.

Recommendation: We maintain a buy rating on this

stock.

GUARANTY (Guaranty Trust Bank) rose by 1.35% to close at

N37.50.

Recommendation: We maintain a buy rating on this

stock.

ZENITHBNK (Zenith Bank) fell by 1.88% to close at N23.55.

Recommendation: We maintain a buy rating on this stock.