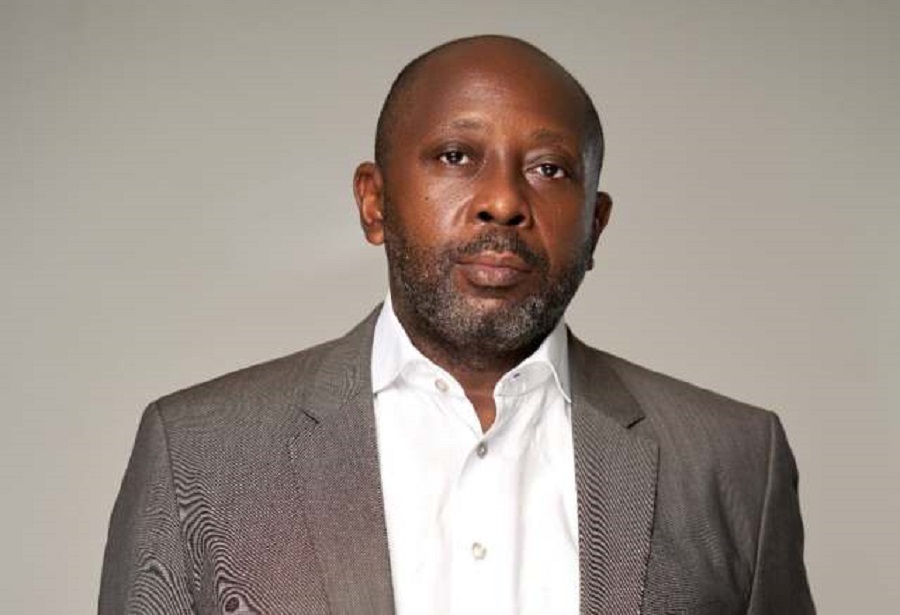

Nairametrics had a brief chat to the Group Managing Director of Flour Mills of Nigeria Plc Paul Gbededo during the Nigerian Economic Summit which held last week.

He touched on several issues including why the company is going into power generation and his outlook for the coming year. Excerpts:

Why Flour Mills is supporting the NESG

The Nigerian Economic Summit Group (NESG) engages the Federal Government, who formulates policies that enable economic development and economic growth. This, in turn, helps businesses run in a sustainable manner.

Of recent Flour Mills has had more investments in the agricultural space, tell us why is this so?

It is our policy in Flour mills to diversify because we cannot forever depend on imports, we have to look for a way to grow our local content. So, in an effort to grow local content, we diversified into agro-allied business.

How has Flour Mills been able to finance these investments?

It is true that financing agriculture is different from other commercial activities. For agriculture you need a longer moratorium, you need single digit cost of funding, and we have been agile and nimble in ensuring that whatever is available from the Government we have access to it; and the Government have been very helpful.

Once you key into the policies of the Government you are a force mover and you can take advantage of the provisions that the Government is making. For instance, in the sugar value-chain, we took advantage of the funding the Government has provided to ensure backward integration and develop our sugar estate, we also took advantage of single digit funding from the Bank of Industry (BoI) and direct intervention from the Central Bank of Nigeria (CBN). This will not only create jobs but also add value and create wealth.

I know Flour Mills and Dangote are working on the Apapa road project. When is it billed for completion?

This project started in June/July last year and it supposed to have been completed by August this year but there has been a delay of about two months; by the end of October, the road project will be completed.

Completing the road without fixing the bridge will still affect logistics in Apapa, so we are looking at the Federal Government completion of repairs on the Apapa bridge and that will ease the pressure on Apapa greatly. We are hopeful that by next year things will better with logistics in that area.

You recently applied for a license for power generation, tell us about the Apapa power plant.

We operate in Apapa we have the capacity to generate 60mw of electricity. Of this, we only need 50% and as such we have a redundancy of 50% which we can supply to our neighbours, that is why we applied for electricity license to enable us to generate and distribute to our neighbours. With that, we will be able to improve the economy of the company and bottom-line.

I am sure you had targets for the year, what have been your achievements and what is the outlook for the coming year?

We had a very good 2017/2018 financial year, which was presented during our AGM in September, our top-line has been growing at a compound annual growth rate of 13% over the last five years and our bottom-line also grew. We had difficulties in the previous two years (2016 to 2017); we came out of that as Nigeria was coming out of recession.

What we expect to see in this 2018/2019 is an improved environment as we have seen in the first quarter. Our disposable income is weak and, therefore, volume growth is not expected in this financial year, but we hope that the last two quarters of the year should be better than the first two quarters we have had, at least we can maintain the growth rate of the top-line even if the margins will be affected.