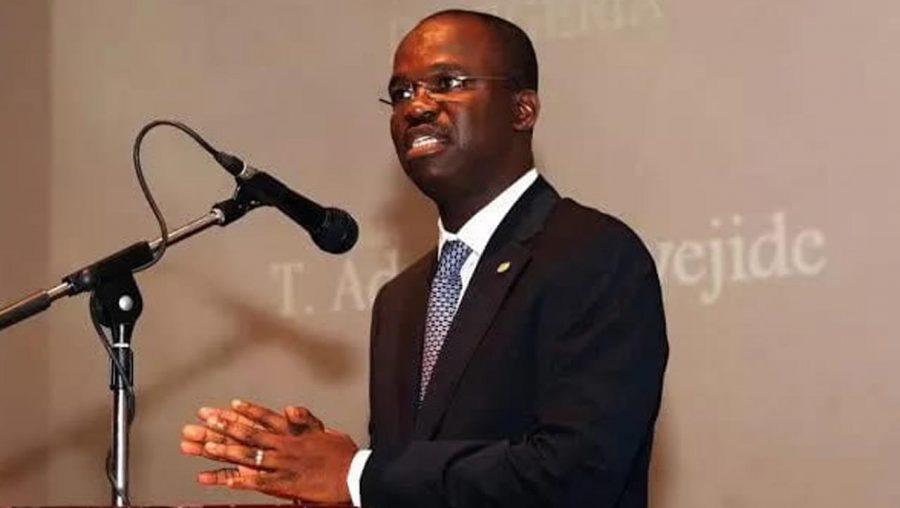

The Group Managing Director (GMD) of Polaris Bank Limited, Tokunbo Abiru has assured customers and shareholders that within the next five years, the newly-announced bank has the potential of becoming one of top five banks in Nigeria.

Abiru brought the assurance to fore, as he premised the continued implementation of the July 2016 regulatory intervention to include entrenching sound corporate governance and risk management practices and transforming Polaris into fully fledged retail and commercial bank with strong digital backing.

The bank’s Managing Director, while addressing 61 graduate trainees of Polaris Business School, held at Polaris Bank Training School, Ibadan, said Polaris Bank can boast of a strong market share going by several transformative business initiatives.

Abiru said

“What we see in the future is a bank that in the next three to five years is one of the first five banks in Nigeria; a fully-fledged retail bank with strong digital backing. So our stakeholders will get more of enhanced values which are clearly different from the bank of the past.

“What we see in the next five years is a stronger retail and commercial bank with an underpinning for digital transformation. I see a major transformation of the bank. Part of the initiatives we continue to deliver following the July 2016 regulatory intervention includes stabilising the institution, entrenching sound corporate governance and risk management practices, and the restoration of depositors’ confidence.”

Recall the Central Bank of Nigeria (CBN), had last month (September 2018) announced an immediate revocation of Skye Bank Plc’s operating license. The bank’s share capital had run into negative territory due to bad loan deals. It was also in urgent need of recapitalisation which its shareholders could not enable.

As part of this development, therefore, Skye Bank Plc was changed to Polaris Bank Limited; a bridge bank to oversee the liquidated entity until Asset Management Corporation of Nigeria (AMCON) finds a new buyer.