Shareholders in the defunct Skye Bank may have lost roughly N10.68 billion due to Friday’s revocation of the bank’s operating licence by the Central Bank of Nigeria (CBN). Skye Bank closed at N0.77 on Friday’s trading session and had a total of 13.88 billion outstanding shares. The bank has a market capitalisation of about N10.68 billion. The bank is yet to release any audited accounts for two years now.

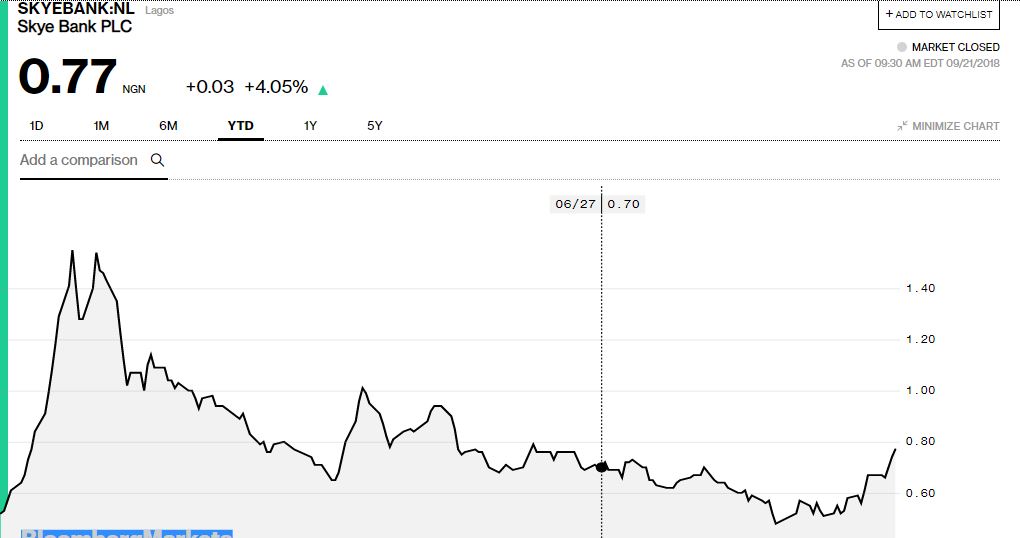

Year to date performance

The stock opened trading this year at N0.52 and closed at N0.77. Investors that bought at the start of the year and held till Friday, were up 48%. The stock was also the second best performing banking stock year to date behind Unity Bank which is up 81%.

Skye Bank peaked at N1.61 per share on the 31st of January this year. Investors at that point would have been up by 209% year to date.

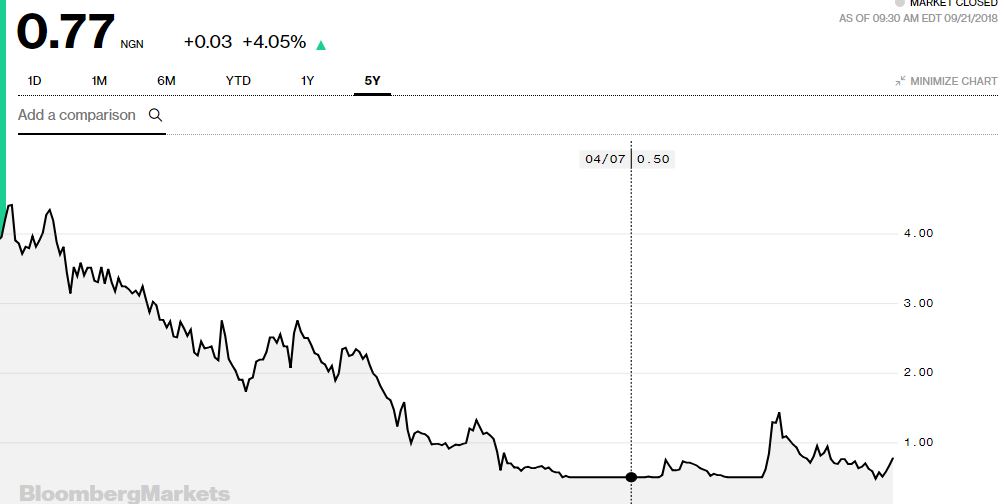

Last 5 years tell a different story

For investors that bought the stock five years ago, they were largely in the red. From N3.90, per share, the stock consistently dropped to N0.77 as at Friday. In essence, their investments lost a whopping 80.2%.

Ten thousand shares bought in 2009 valued at N39,000, would have been worth N7700 as at yesterday.

Public Offer woes are worse

Investors that bought the stock during its last public offer in 2008, and held till date, have even larger tales of woe. The public offer was priced at N14 per share. 10,000 shares bought at N140,000 would be valued at N7700 as at yesterday. In essence, 94.5% of their holdings was wiped out.

What to do if you own the shares?

The Nigerian Stock Exchange announced that it has placed the shares of the company on technical suspension meaning that it cannot be sold or bought till further notice. For investors who own this stock, it is more likely that they may have lost their entire investment in this bank. The CBN has yanked off its license, moved its asset and liability to another bank and transferred its board and employees to Polaris Bank.

Legal pundits suggest the shareholders of the bank may have to seek legal redress or they are not getting anything from the bank. This is because the shareholder funds are assumed to have been wiped out following the injection of funds by the CBN.

Retail investors who may have then bought the shares of the company before Friday, will have to wait till the sale of Polaris bank is consummated. In the meanwhile, make sure you keep evidence of your purchase of the stock. You may also contact the registrar’s of the company to confirm the status of your holdings and that you be notified if there are any new information. You should also set google alerts which will help you monitor any new information about Skye Bank and Polaris Bank.