It is a known fact that Nigerians eat a lot of fish. Much like it is the case in many parts of the world, fish is a staple, often used for the preparation of pepper soup, fish stew, and even soul food. Due to the high rate of fish consumption in Nigeria, there is an ever-growing demand for the commodity in the country. This is why Ellah Lakes Plc is important.

It should be noted that Nigerians consume an average of 3.32 million metric tonnes of fish per annum, according to statistics obtained from the Fishery Committee for West Central Gulf of Guinea. Unfortunately, most of the fish consumed in Nigeria is imported. This is despite the fact that the country is one of the most naturally endowed places on earth to breed the aquatic animal. As a matter of fact, the country has all it takes to locally produce the commodity and be self-sufficient enough to export to other parts of the world.

While there are many subsistence fish farmers operating smallholder fish ponds across the country, Ellah Lakes Plc is one of the few fully-established corporates that are engaged in this business. Upon inception, the company set about redefining this area of agriculture through the use of sustainable and technologically-enabled approaches. Unfortunately, the company is now at risk of being liquidated, even though efforts are being made to salvage the situation.

For this week’s company profile on Nairametrics, our focus is on this company. Get to know everything about it, its many years of operation in Nigeria, the board of directors, ownership structure, competition, and most especially, how it has been able to maximise the immense opportunities at its disposal towards ensuring profitability.

A corporate overview of Ella Lakes Plc

Ellah Lakes Plc is a Port Harcourt-based Nigerian company specialised in the breeding, packaging and sale of fish. The company also engages in other related agricultural activities, specifically palm plantation. It was founded on August 22, 1980, by Nigerian politician, Senator F.J. Ellah. Although initially incorporated as a limited liability company, Ellah Lakes later converted to a public liability company on June 16th, 1992. By January 14th, 1993, the company’s shares were listed on the Nigerian Stock Exchange (NSE).

As one of the leading freshwater fish producers in Nigeria, Ellah Lakes prides itself as an environmentally-conscious company. In other words, it imbibes sustainable means in its fish farming processes by “ensuring that nature will continue to be able to replenish herself to meet the demands of the growing population who will want to continue to enjoy fish and fish-based products.”

About the company’s segmentation and services

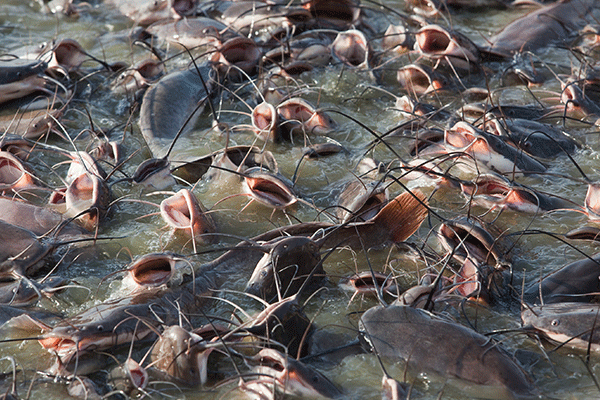

As already noted above, Ellah Lakes Plc is broadly divided into two major segments: fish farming/processing and oil palm plantation. Under the fish farming segment, the company breeds assorted freshwater fish (but mainly catfish) and processes same for final distribution to the market. This segment, which also consists of fish conditioning, smoking and storing services, generates much of the company’s revenue.

Meanwhile, the company also complements its fish farming activities with palm tree plantation. It should, however, be noted that Ellah Lakes has yet to fully explore the potentials inherent in oil palm business. This could serve as a viable option, especially so at this point in time when the company is struggling to keep afloat.

The company’s target market

Ellah Lakes Plc primarily targets Nigerian fish consumers, offering a wide range of freshwater fish in order to ensure a nourished Nigeria. It is one of the few indigenous companies that has dedicated effort towards ensuring that fish importation into the country is reduced. It now appears to be failing in this bid.

A brief look at the company’s Board of Directors

According to information available in the company’s full-year 2018 financial report, there are eight members on the Board of Directors. They are:

- Mr. Frank Ellah: Managing Director/CEO

- Deacon Tom O. B. Ogboi: Director

- General Zamani Lekwot (Rtd): Director

- Mallam Suleiman Buda Usman: Director

- Mr. O. Adeyemi Wilson: Director

- Mr. Umar Munir Abubaka: Director

- Mrs. Patricia Ireju Ella: Director and

- Dr Chiamaka Mine Cookey-Gam: Director

Is the company faced with any competition?

Of course, Ellah Lakes Plc has no choice than to contend with competition, especially in view of the fact that much of the fish consumed by Nigerians are imported. Asides importation, the company also faces competition posed by other smallholder fish farmers including the likes of Everest Farms Limited, TeeMartins Aquaculture, Amolese Aquaculture Nigeria Limited, etc.

Meanwhile, in the area of oil palm plantation farming, Ellah Lakes also faces stiff competition posed by dominant players such as Okomu Oil, and Presco Plc, amongst others.

The company is under threat

Perhaps Ellah Lake Plc’s major problem is not the competition it faces. After all, it is important that all hands be on deck in order to adequately cater to the fish needs of the one hundred and eighty million plus people that make up the population of Nigeria. Instead, the company’s major problem is the threat facing its fish farms in Omuaku, Rivers State.

According to an explanation given by the company for its financial performance in full-year 2018, the activities of militants around the Omuaku area has forced the company to shut down its farming activities. In their own words:

“As a result of militancy activities in the area where the farm is located, the company has suspended business activities until the environment is safe for business activities. The directors are exploring strategies to keep the company afloat.” – Ellah Lakes

The company’s finances have suffered

With no reasonable production activities taking place since last year due to the fear of militants, it is not surprising that the company has recorded losses. For instance, in the full year ended July 31st 2018, it made a loss of N10.788 million, a further decline compared to a loss of N5.961 million recorded in the preceding year.

Meanwhile, the company is taking major remedial action

As we reported, the company plans to request of its shareholders to grant permission for a capital raise to the tune of N5 billion. This permission is expected to be granted on September 27th during the company’s Annual General Meeting. The funds are expected to facilitate the other strategies, which the company’s Board is exploring in a bid to keep the company afloat. It should, however, be noted that the anticipated permission may not come easily as shareholders may disagree from fear that the move will result in a dilution of their shares.

Other possible solutions

It has become imperative that Ellah Lakes Plc really considers a complete reassessment of its entire business model. In view of the threat posed by militancy, for instance, it may consider relocating its farms to other places such as Lagos State. Moreover, the company should consider expanding its oil palm segment more because doing so could potentially position it for greater profitability.

Lagos or Ogun state along the Sagamu Lagos Interchange axis would be a kill as location for their fish farm. This is the same reason why no shipper or importer would use the ports in SS. Pathetic.