NNPC’s trading surplus rises to N17bn in one month

Bonds

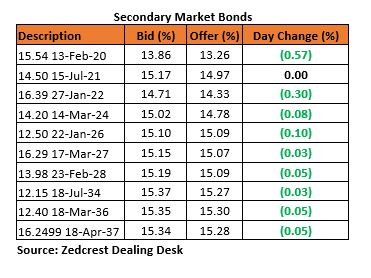

Yields in the bond market compressed further by c.13bps in today’s session, capping a 23bps w/w decline in yields. This came on the back of renewed local client interests mostly on the short and mid tenured bonds. We witnessed the most interests today on the 2020, 2021 and 2027 bonds, while other tenors compressed slightly in response to the mild bullish sentiments.

In the coming week, we expect a slight reversal to this trend, with bids expected to weaken in anticipation of the forthcoming bond auction. Whilst not discounting the renewed interests from clients in recent sessions, we do not expect yields to break below a c.15.00% support level on the mid to long end of the curve.

Treasury Bills

T-bills market traded on a calm note, with yields compressing slightly by c.10bps on average, due to slight buys mostly on the short end of the curve (Oct & Nov maturities), as market players looked to invest excess cash flows in absence of an OMO auction by the CBN. The longer end of the curve was also slightly active with some client flows seen on the 19-Sep.

In the coming week, we expect yields to remain relatively stable, as the CBN has begun to show some temperance for liquidity in the system.

Money Market

The OBB and OVN rates remained stable, closing today at 4.00% and 4.75% respectively, as there were no significant outflows from the system which opened the day at c.N518bn positive.

In the coming week, we expect rates to remain moderated with inflows from OMO maturities and FAAC payments expect to offset outflows for CBN’s OMO and FX auctions.

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.30/$ (spot) and N360.94/$ (SMIS). At the I&E FX window a total of $401.69mn was traded in 289 deals, with rates ranging between N358.00/$ – N365.00/$. The NAFEX closing rate depreciated by c.0.11% to N363.68/$ from N363.27/$ previously.

At the parallel market, the cash rates depreciated by 10k to N359.80/$, while the transfer rate remained unchanged at N362.00/$.

Eurobonds

The NGERIA Sovereigns remained bullish in today’s session, with yields compressing by c.12bps on average, consequently capping a c.14bps w/w decline in yields. Interests were more focused on the shorter end of the curve today, with the most interests seen on the Jan 2021.

The NGERIA Corps remained slightly bullish, with the most interests seen on the Zenith 19s and FBNNL 21s.