Oil Prices Slip after Trump Slams OPEC on Twitter

Bonds

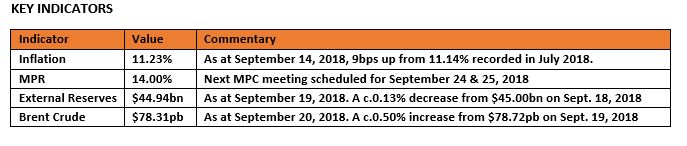

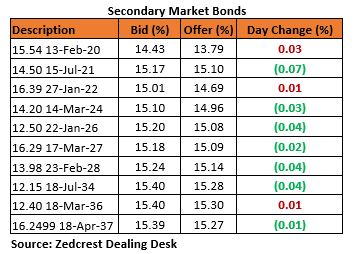

The bond market remained scantily traded, except for some client interests we witnessed mostly on the short and mid-tenured bonds. Yields compressed marginally by c.2bps, as the market remained relatively flat week to date.

We expect this trend to persist in the interim, whilst market players closely watch out for the US FOMC and Nigeria MPC meetings, and the FGN Bond auction which would hold in the coming week. Our sentiment remains slightly bearish, with the FOMC expected to hike rates for a third time this year; the MPC though expected to hold rates might sound more hawkish, while we anticipate a further hike in the FGN bond auction rates, in tune with the recent developments in the secondary market.

Treasury Bills

Yields in the T-bills market moderated further by c.30bps as market players continued to cherry-pick on attractive yields on the shorter end of the curve due to the significantly buoyant level of liquidity in the system.

Spreads tightened across the curve as the relatively high level of uncertainty in previous sessions ebbed, following an OMO auction by the CBN, where the PMA bills offered in the previous session were repeated, with demand mostly on the 364-day bill which cleared at 13.50% with a total sale of N306.55bn.

Barring a further OMO auction by the CBN, we expect yields to be relatively stable, due to the buoyant level of liquidity in the system. Market players are expected to prefer the longer end now above the short end of the curve.

Money Market

The OBB and OVN rates remained relatively stable, closing today at 4.17% and 4.75% respectively, as inflows from OMO T-bill maturities (c.N218bn) helped offset outflows from today’ OMO auction sales (c.N337bn), consequently sustaining system liquidity at c.N560bn positive.

We expect rates to close the week on a calm note, barring a further OMO auction by the CBN.

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.30/$ (spot) and N360.94/$ (SMIS). At the I&E FX window, a total of $401.69mn was traded in 386 deals, with rates ranging between N358.00/$ – N365.00/$. The NAFEX closing rate depreciated by c.0.08% to N363.27/$ from N362.97/$ previously.

At the parallel market, the cash rates depreciated by 30k to N359.70/$, while the transfer rate remained unchanged at N362.00/$.

Eurobonds

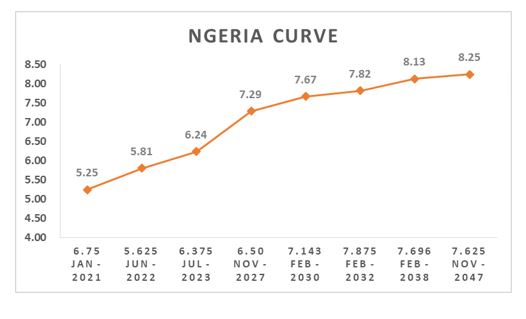

The NGERIA Sovereigns traded on firmly bullish note in today’s session, following the resurgent interests across most EM assets. Yields declined by c.13bps on average, with the most interests seen on the Nov 2047 bond which gained a whopping 2.00 percent on the day.

The NGERIA Corps were also slightly bullish, with interests seen on the ZENITH, UBANL and FIDBAN 22s. The top gainer was the FIDBAN 22s which gained about 0.50pct on the day.