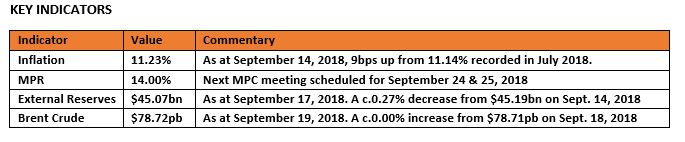

Nigeria’s Total Public Debt at $73 Billion in Second Quarter – NBS

Bonds

The bond market remained scantily traded, with trading activities almost non-existent in the two-way market, except for some buys on the 2021 and 2027 bonds which compressed yields marginally by c.2bps on average.

Whilst we note that demand pressures in recent sessions have been largely locally driven and more concentrated around the mid tenors, we expect the market to tilt towards a slightly more bearish stance as we approach the FGN bond auction scheduled to hold next week.

Treasury Bills

Activities in the T-bills space remained mostly concentrated on the short end of the curve, with rates declining further by c.100bps down to single digit levels on the October maturities. This was due to the significantly buoyant level of system liquidity which came on the back of inflows from Paris club payments to states. We also witnessed slight interests on the March maturities, while yields remained relatively unchanged across other tenors as market players remained cautious in anticipation of results from the Primary Market Auction.

Market Players Significantly oversubscribed the 1yr bill by c.250% at today’s PMA. This consequently forced rates lower by c.3bps from their previous levels, down to 13.475%. The 91- and 182-day bills were also slightly oversubscribed, with rates on the 91-day maintained at 11%, while the 182-day cleared 10bps lower at 12.20%.

Despite this significantly positive result, we expects sentiments in the market to be dampened by an OMO auction expected to be floated by the CBN tomorrow. We however expect strong demand for the 1-yr bill, due to the huge amount of lost bids at the auction. If the CBN fails to offer this bill at the OMO tomorrow, there will be a slight rally on that end of the curve.

Money Market

The OBB and OVN rates declined sharply to lower single digits, closing today at 4.75% and 5.75% respectively. This came on the back of inflows from Paris club refunds to states which bolstered system liquidity significantly higher to c.N720bn from c.N290bn previously.

We expect rates to remain moderated tomorrow due to expected inflows from OMO T-bill maturities (c.N218bn).

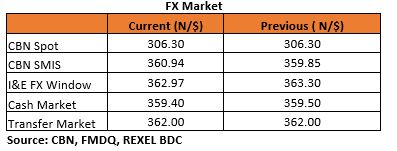

FX Market

The Interbank spot rate remained stable at N306.30/$, while the SMIS rate rose by 0.30% to N360.94/$ from N359.85/$ previously. At the I&E FX window, a total of $491.37mn was traded in 305 deals, with rates ranging between N358.00/$ – N364.75/$. The NAFEX closing rate appreciated by c.0.09% to N362.97/$ from N363.30/$ previously.

At the parallel market, the cash rates appreciated by 10k to N359.40/$, while the transfer rate remained unchanged at N362.00/$.

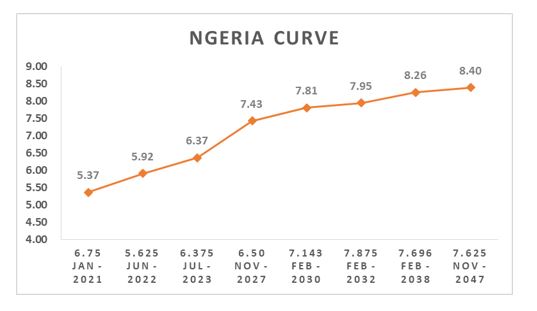

Eurobonds

The NGERIA Sovereigns strengthened slightly in today’s session, following slight demand on the longer end of the curve. Investors were mostly bullish on the 2047s which gained c.0.60pct on the day.

The NGERIA Corps were mostly quiet for the day, except for slight interests seen on the Access 21s Sub which gained about 0.20pct.