CBN injects $303m, CNY 46.58m into forex market

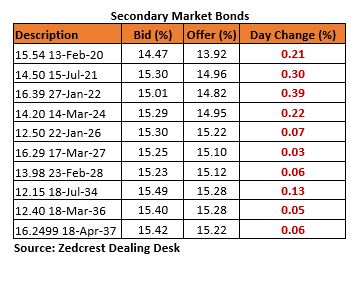

Bonds

The Bond market remained largely order driven, with selloffs witnessed mostly on the shorter end of the curve, in reaction to the hike in longest tenor OMO stop rate to c.13.30% eff. yield by the CBN in the previous session. Yields consequently rose higher by c.15bps across the curve, with the most selloff seen on the Jul 2021 and Jan 2022 maturities.

In the coming week, we expect yields to maintain an upward trend, as market players maintain a relatively risk off stance in tune with recent developments in short term interest rates.

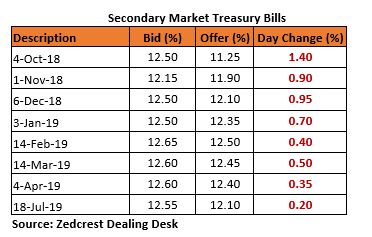

Treasury Bills

In tune with the recent hike in stop rates at the last OMO auction by the CBN, the T-bills market traded on a significantly bearish note, with yields rising by c.80bps on average across the curve. We witnessed the most selloffs on the shorter dated maturities (sept – Dec), while market players were relatively more moderate in their selloff on the mid to long end of the curve.

In the coming week, we expect market players to remain cautious, despite the significantly buoyant level of system liquidity at c.N540bn positive. Barring continued offshore selloff, we expect some retracement, especially on the shorter dated maturities.

Money Market

Following a net OMO repayment of c.N100bn in the previous session, the OBB and OVN rates declined further to 2.83% and 3.42% respectively, as the market remained awash with liquidity at c.N540bn positive.

We expect rates to remain moderated in the coming week, barring a significant increase in the spate of OMO interventions by the CBN. We however expect rates to close higher w/w as the CBN is expected to conduct its bi-weekly Retail FX auction on Friday.

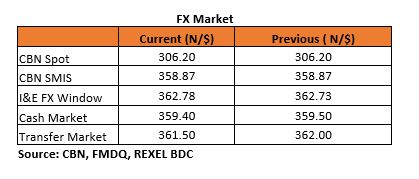

FX Market

The Naira/USD rate remained stable at the interbank, closing at N306.20/$. At the I&E FX window, a total of $249.84mn was traded in 293 deals, with rates ranging between N350.00/$ – N364.50/$. The NAFEX closing rate depreciated marginally by c.0.01% to N362.78/$ from N362.73/$ previously.

At the parallel market, the cash and transfer rates appreciated by 10k and 50k to close at N359.40/$ and N361.50/$ respectively.

Eurobonds

The NGERIA Sovereigns maintained its bullish recovery in today’s session, with yields compressing further by c.12bps across the curve. This came on the back of a slowdown in the intense EM selloffs witnessed earlier in the week. We witnessed the most gains today on the Feb 2032s, which gained about 1.15pct on the day. Yields however closed weaker by c.5bps w/w.

The NGERIA Corps were conversely bearish, with the most selloff witnessed on the DIAMBK 19s and FIDBAN 22s, consequently reversing some of the earlier gains on the tickers.