Bonds

The Bond Market resumed on a slightly bullish note, due to renewed demand from local clients mostly on the mid-tenured bonds (26s -28s), which caused yields to trend lower by c.9bps across the curve.

Yields have shown resistance at the 15% mark, and we do not expect this to be significantly breached in the near term. This is however barring a resurgence in offshore selloff, which has been recently tapered by moderating sentiments across the EM space.

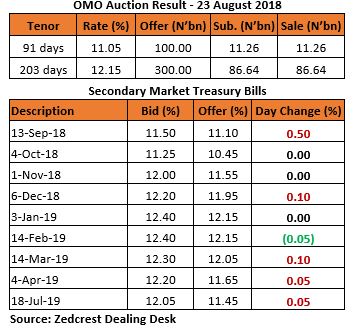

Treasury Bills

The weak demand in the T-bills space persisted in today’s session, as the CBN resumed its OMO interventions in the market. The OMO auction demand remained weak for the second week in a row, as the CBN was also only able to rollover a total of N97.90bn of the N364.33bn bills that matured.

We expect yields to close the week on a relatively stable note as the market remains well supported by the relatively buoyant level of system liquidity.

Money Market

The OBB and OVN rates trended lower, closing today at 6.83% and 7.75% respectively. This was due to an increase in system liquidity levels, as net inflows of N266.43bn in OMO maturities hit the system. System liquidity is consequently estimated at c.N600bn as at close of business today.

We expect rates to close the week at single digit levels, with the outside chance of the CBN floating another OMO auction tomorrow to manage liquidity levels.

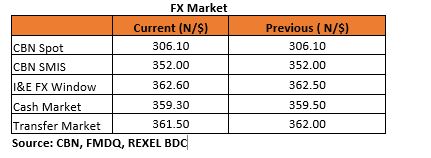

FX Market

The Naira/USD rate remained unchanged at the interbank, closing at N306.10/$. At the I&E FX window, a total of $167.78mn was traded in 302 deals, with rates ranging between N359.00/$ – N364.00/$. The Naira depreciated by 0.03% to close at N362.60/$.

At the parallel market, the cash and transfer rates appreciated by 0.06% and 0.14% respectively to close at N359.30/$ and N361.50/$ respectively.

Eurobonds

Demand interests on the NGERIA Sovereigns continued in today’s session, as yields declined further by c.12bps on average. The most interests were on the Feb 2030 and Nov 2047 bonds which gained +0.18pct and +0.21pct respectively.

Similarly, the NGERIA Corps also witnessed slight interests, notable on the ACCESS 21s Snr and FIDBAN 22s.