Gencos Give Six Conditions to Avoid Operational Shutdown

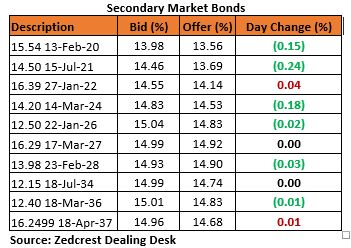

Bonds

The Bond Market traded on a relatively calm note, with yields retracing by c.6bps from its previous session highs, as market players cherry-picked on offers, mostly on the shorter end of the curve. We however witnessed slight sell on the 2037s toward the close of trading, with trades at 14.96%.

With markets closing for a 2-day break, we expect renewed demand from clients opening Thursday, with market sentiments relatively supported by the buoyant level of system liquidity and the slowdown in offshore selloff, noticeably absent in today’s session.

Treasury Bills

The T-bills market traded on a relatively flat note, with most activities focused on the shorter end of the curve, as market demand remained relatively weak despite the significantly buoyant level of system liquidity. Yields consequently compressed marginally by c.2bps on average.

We expect yields to trend slightly higher on Thursday due to the anticipated resumption in OMO auction sales by the CBN.

Money Market

The OBB and OVN rates remained at single digit levels, closing today at 8.83% and 9.58% respectively. This was as the buoyant level of system liquidity supported outflows for today’s wholesale FX provisioning of c.N70bn. System liquidity is consequently estimated at c.N400bn as at close of business today.

We expect rates to remain at single digit levels for the rest of the week, with inflows of c.N364bn from OMO maturities expected on Thursday.

FX Market

The Naira/USD rate remained unchanged at the interbank and I&E FX window, closing at N306.10/$ and N362.50/$ respectively. At the parallel market, the cash and transfer rates also remained unchanged at N359.50/$ and N362.00/$ respectively.

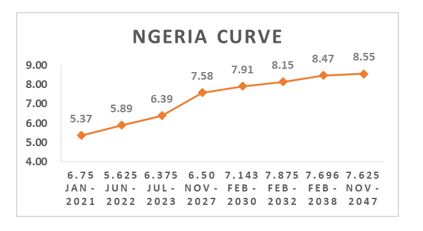

Eurobonds

We witnessed relatively moderate interests on the NGERIA Sovereigns in today’s session, as yields declined by c.7bps on average. The most interests were on the Jun 2032 and Nov 2047 bonds which gained +0.50pct and +0.60pct respectively.

Trading on the NGERIA Corps were relatively muted except for slight interests witnessed on the ACCESS 21s Snr, UBANL 22s and FIDBAN 22s.