Bond Yields Spike in Panic Driven Session

*** Osinbajo meets DSS’ most senior director, Seiyefa, Magu***

Nigerian Central Bank ‘in the Mood for Tightening,’ – Nnanna

Normal

0

false

false

false

EN-US

X-NONE

X-NONE

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:”Table Normal”;

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:””;

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin-top:0in;

mso-para-margin-right:0in;

mso-para-margin-bottom:8.0pt;

mso-para-margin-left:0in;

line-height:107%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:”Calibri”,sans-serif;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;}

KEY INDICATORS

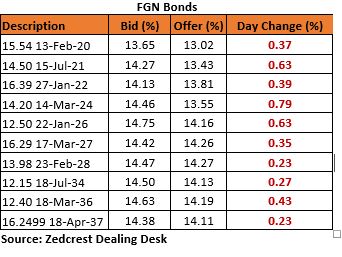

Bonds

The Bond market witnessed a spur of activity in today’s session, as a flurry of headline political news dominated trading sentiments over the course of the session. We witnessed continued selloff by offshore clients mostly on the 2027s and 2028s as tensions in the political space further strengthened their recent bearish position on the market.

We also noted a shift in the date of the scheduled bond auction for the Month of August to 15-Aug from the earlier scheduled date of 22-Aug. This is also believed to have influenced some selloff, especially on the 2028s, as market players anticipate renewed supply of bonds at the auction now scheduled to hold next week. Yields consequently shot higher to close at c.43bps above their previous levels as most market players pulled off on their bids following some selloff on the 2027s to c.14.38% towards the close of trading.

The aforementioned notwithstanding, we noticed a relatively slower rate of change in offer prices across other maturities, with slight demand even observed on the 2036s. We consequently expect a narrowing of bid-offer spreads in tomorrow’s session, but with the broader market sentiment expected to remain bearish as we approach the forthcoming bond auction.

Treasury Bills

The T-bills market remained relatively flat, with most activities focused on the shorter end of the curve. Yields consequently remained relatively flat on average.

We expect a slight downtrend in yields tomorrow, on the back of a relatively buoyant level of system liquidity. Trading activities are however still expected to be focused on the shorter end of the curve

Money Market

The OBB and OVN rates remain relatively unchanged, closing today at 7.52% and 8.42% respectively, as there were no significant outflows from the system which opened today at c.N330bn positive according to figures published by the CBN.

We expect rates to remain stable tomorrow, as there are no significant outflows expected from the system.

FX Market

The Naira remained stable N306.00/$ at the interbank market. It however depreciated by 0.09% at the I&E FX window, closing at N362.30/$ (from N361.96/$ previously). At the parallel market, the cash and transfer market rates remained stable at N358.50/$ and N361.50/$ respectively.

Oil prices strengthened further today, with Brent crude futures rising by c.50cents to $74.40pb, even as the Chinese Yuan Denominated futures jumped to an all-time high, creeping above the Brent and WTI. The CBN’s External reserves has however maintained a steady decline, falling by c.0.30% to $46.87bn as at 6-Aug, from $47.01bn on the 3rd of August.

Eurobonds

The NGERIA Sovereigns turned bearish in today’s session, with yields rising by c.7bps on average. We witnessed the most selloff on the Jan 2021 which rose by c.12bps, consequently reversing recent gains. The 2038s however lost the most in price terms down by c.0.70pct (+6bps) d/d.

Activities in the NGERIA Corps remained relatively muted, except for slight demand for the FBNNL 21s, following redemption of the FBNNL 20s today. We also witnessed slight selloff on the ACCESS 21s Snr and UBANL 22s.