The Nigerian pension fund industry has been growing since the enactment of the pensions act of 2004 and pension assets have grown to about N8.14 trillion over a short period of time, according to the last report from PenCom.

This growth is a combination of pension contributions by both employers and employees as well as gains from fund performance. Not only has the industry been growing by way of asset size, there are growths in the number of pension fund administrators, custodians and more importantly on the number of people registering for pension fund coverages.

Of importance also is the number of companies that are in compliance with their contributions. One good thing about compliance with pension contributions is that it not only helps to retain talented employees in the compliant company, it also helps to attract good ones from seemingly non-compliant or not-so-compliant companies.

In deciding to work for a company, prospective employees pay attention not only to their take home pay but also to life after employment by paying attention to the prospective employers’ pension policy. In the US for example, a company that has a 4% company match for their employees’ 401k contributions, is less likely to attract talented work force than one that has a 6% 401K match policy. By the way, 401K is a type of defined contribution pension plan, just like the RSA and Retiree funds in Nigeria.

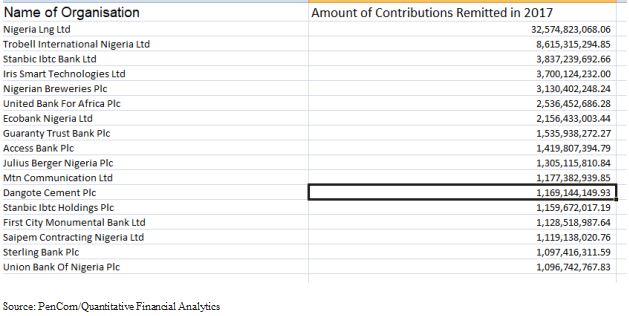

According to available information, as at July 26th ,2018, 11,877 companies have received their compliance certificates from the National Pension Commission for 2017 contributions which total about N107.6 billion. The certificates act as evidence of their compliance with collection and remittance of pension contributions. Of the 11,877 compliant companies, 17 made contributions in excess of N1 billion.

The billionaire contributors’ list is dominated by companies in the banking or financial services business while those in construction, communication, manufacturing and digital technology business were also represented, howbeit sparely. While 9 of them are banks, 2 are from manufacturing, 1 construction, 2 extraction and mining while 2 are tech companies.

Those 17 companies contributed a total of N68.8 billion or 64% of all the contributions made in 2017. The greatest contributor is Nigeria LGN Ltd, which contributed N32.5 billion followed by Trobell International Nigeria Ltd with a contribution of N8.6 billion. Iris Smart Technologies Ltd and Nigerian Breweries Plc’s contribution of N3.7 and N3.1billion place them in the third and fourth positions of the billion Naira contributors respectively.