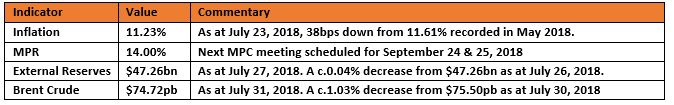

KEY INDICATORS

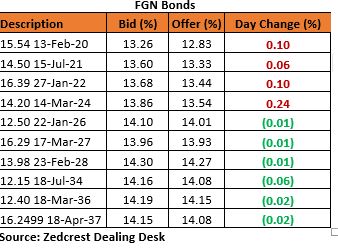

Bonds

The bond market traded today with mixed sentiments with demand seen on the medium to long end of the bond yield curve (2028s to 2037s) while we saw the bid/offer spreads widen on the short end of the curve with no single trade executed in the market.

We expect renewed demand to come into the market in the new month especially for bonds yielding above the MPR. Local investors are expected to continue their search for some yield bargain especially on the medium to long end of the curve.

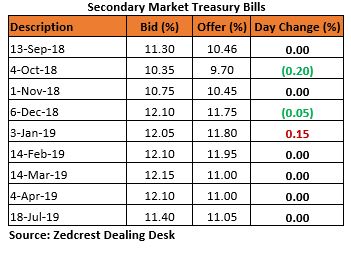

Treasury Bills

The Treasury bills market was also scantily traded, with slight bearish sentiments witnessed on short-end of the curve due to end of month profit taking activities. The medium and long end of the curve traded flat as market participants close their books for the month.

The DMO will conduct a T-bills Primary Market Auction (PMA) tomorrow, with N9.54bn, N69.57bn and N136.52bn of the 91-, 182- and 364-day bills expected to be rolled over. We expect rates to clear between 10.00%-10.20%, 10.30% – 10.50% and 11.40%-11.60% for the 91, 182 and 364days papers respectively.

We expect the T-bills market to trade cautiously tomorrow as market participants keep an eye on the outcome of the PMA.

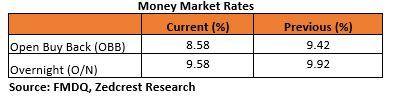

Money Market

Interest rates closed the month on a calm note as the Open Buy-Back (OBB) and Overnight (O/N) rates remained steady at 8.58% and 9.58% respectively. System Liquidity is estimated to close at c.N511bn positive due to the late credit of the monthly FAAC allocations into the system.

We expect rates to trend southwards tomorrow on the back of the FAAC disbursements, however, the CBN may be poised to conduct an OMO auction to mop up excess liquidity from the system.

FX Market

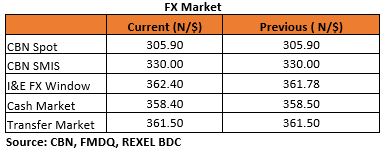

The Naira remained relatively stable, with the Interbank rate closing flat at N305.90/$. The NAFEX rate depreciated by 62k, closing at N362.40$ (c.0.17% down from N361.78/$ previously).

Rates in the parallel market closed the week on a flat note as the USD cash and transfer rates closed at N358.40/$ and N361.50/$ respectively.

Eurobonds

The NGERIA Sovereigns closed the month on a bearish note, as yields inched up by an average of c.5bps across the traded tickers.

The NGERIA Corps space continued to attract demand with yields compressing by an average of c.8bps across the curve. The SEPLLN 23s remained the toast of investors, with a significant yield decline of c.72bps day on day. The ZENITH 19s & DIAMBK 19s also attracted some demand with yields compressing by c. 10bps on the average on those tickers.