KEY INDICATORS

Bonds

The Bond market open the week on a relatively quiet note, as yields compressed by a single basis point on average across the curve. Spreads opened the week wider, as demand was witnessed on some select maturities on the long end, especially on the Mar-2036s as yields compressed by 6bps on that maturity.

In the coming week, our expectations for a weaker market remain, however continued for robust system liquidity continue to provide support for demand pressures.

Treasury Bills

The T-bills market witnessed increased activities, with demand witnessed on the mid-end of the curve. Yields closed lower by c.7bps on average, as market players were particularly bullish on the 17-Jan maturity (19bps).

We expect market to be remain bullish amidst buoyant system liquidity, with c.N324bn OMO T-bills maturing on Thursday. The DMO will also conduct a primary auction on Wednesday to rollover c.N207bn in T-bills maturities. Expectations remain for stable or lower stop rates at the auction as the DMO continues its strategy to refinance local debt at lower costs with repayments from proceeds of the Eurobond issued earlier this year.

Money Market

The OBB and OVN rates increased opening the week, off the back of outflows via the CBN’s SMIS auction conducted at the close of the previous week. The OBB & O/N rates closed at 9.42% and 9.92% respectively. System liquidity is consequently estimated to close be lower at c.N188.04bn positive.

Rate are expected to remain in single digit territory, as funding pressures on market players reduce as well as liquidity expected later in the week from OMO maturities and expected FAAC payments

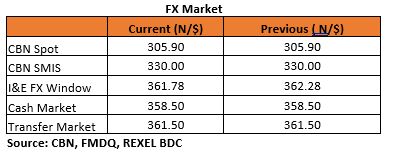

FX Market

The Naira remained stable at N305.90/$ in the Inter-bank market, whilst appreciating by 0.14% to N361.78/$ at the I&E window. The Parallel market rates remained flat, closing at N358.50/$ and N361.50/$ at the Cash and transfer market segments respectively.

Eurobonds

The Nigerian Sovereigns were mixed, leaning bearish, with yields expanding by c.2bps across the curve. The sell-offs were witnessed on the short-end of the curve, with yields on the Jan-2021s, Jan-2022s and Jul-2023s all expanding by 4bps on the average.

Investors were also slightly bullish on the Nigerian Corporates, with most interest seen on the SEPLLN 23s following a positive earnings report for the first half of 2018.