The Nigerian tech ecosystem is undoubtedly one of the most vibrant in the whole of Africa. It is also the most alluring for many startup founders who are constantly innovating, while taking advantage of the opportunities that abound.

In view of the innovations and disruptions, it is important not to forget that some companies earlier paved the way for the success we now see. One of such companies is Chams Plc, which by the way, is an NSE-listed corporation though it is not so popular.

For today’s company profile, we shall be looking at Chams Plc, focusing on everything from its history to its various services, management team/board of directors, and of course, the investment prospects. Most importantly, we shall also be looking at how the company manages to stay relevant amidst growing competition. Get to know more about Chams Plc.

Corporate information about the company: incorporation date, founder and more

Chams Plc is a Nigerian company which operates in the ICT sector. At the core of its business model is identity management and e-Payment service provision. It works with several government ministries/agencies, and even private companies to document the identities of Nigerians, while verifying same whenever needed.

The company was founded by Sir Demola Benjamin Aladekomo and incorporated in 1985 as a private limited company, initially serving as a computer and hardware maintenance service provider. But in the course of about thirty years, it has transformed to become one of the biggest providers of all-round technology solutions in Nigeria. Information available on their website claims that it has been a part of Nigeria’s identity management history since 1992.

It is important to note that Chams Plc has a number of ‘firsts’ under its credit. It is said to have pioneered the first card payment scheme in Nigeria. The card payment scheme, which was a partnership with VISA, is called Valucard. It has received license from the Central Bank of Nigeria to provide services such as POS terminal service provision, mobile payment, prepaid card issuance, independent ATM deployment, etc.

The company is also reputed to have set up the ChamsCity Digital Mall, a feat for which it received a Guinness World Book of Records’ feature. It is also one of the foremost ICT companies to have its equities listed on the floor of the Nigerian Stock Exchange.

Moving on, Chams Plc is the front-end partner to the National Identity Management Commission (NIMC), the rather inefficient government agency responsible for assigning unique identification numbers to Nigerians.

The company has four subsidiaries which include:

- Chams Access

- Chams Switch

- Card Centre

- Chams Mobile

A look at the company’s target market

Chams Plc targets government agencies and private companies with its identity management and e-Payment solutions. As such, some of the company’s most notable clients include the Independent National Electoral Commission (INEC), the Nigerian Customs Service (NCS), Nigerian Airforce, the National Health Insurance Scheme (NHIS), Nigerian Communications Commission (NCC), ICAN, PenCom, NAHCO, etc.

The company’s business outsourcing arm also caters to the needs of corporates by providing facilities for computer-based/e-Testing centres across Lagos and elsewhere. It also offers training and provides training spaces for organisations, while also offering contact/call centre services.

Here are some of the individuals on the company’s board of directors

Mr. Sunday Olufemi Williams, the Chief Executive Officer: This highly-experienced business executive has had a nearly three-decades-long career at Chams Plc, having started out in 1989 as a Corps Member. He is a graduate of the Obafemi Awolowo University, graduating in 1989 with a degree in Electronics and Electrical Engineering. He also has a Master’s in Business Administration from the Abubakar Tafawa Balewa University, Bauchi.

He is an alumnus of the Massachusetts Institute of Technology (MIT) and the Lagos Business School where he has completed different kinds of academic/professional programmes.

Due to his many contributions towards ensuring the growth of the company, Mr. Williams was constantly promoted. He was a Non-Executive Director at Chams Plc for more than fifteen years. By 2012, he became the Deputy Managing Director, a position he held till 2015 when he was appointed as the Group Managing Director/CEO, a position he still occupies till date.

Sir Demola Aladekomo (Founder/Non-Executive director): He is the brain behind Chams Plc. After many years of working hard to build the company, he retired in 2015 as the Group Managing Director. He currently serves as a Non-Executive Director in the company.

He graduated from the Obafemi Awolowo University, Ife, in 1982 with a degree in Computer Engineering. By 1984, he had bagged an MBA from the University of Lagos. He is also an alumnus of the Lagos Business School, as well as a Member/Fellow of different associations, including the Nigerian Computer Society and Computer Professional Registration Council (FCPN), etc.

Sir Demola currently sits on the board of several organisations.

Other notable members of the company’s Board of Directors include:

- Very Rev. Ayo Richards: Chairman

- Mrs. Funke AlomoOluwa: Executive Director

- Mrs. Mayowa Olaniyan: Executive Director

- Dr. Evans Woherem: Non-Executive Director, etc.

The company’s ownership structure

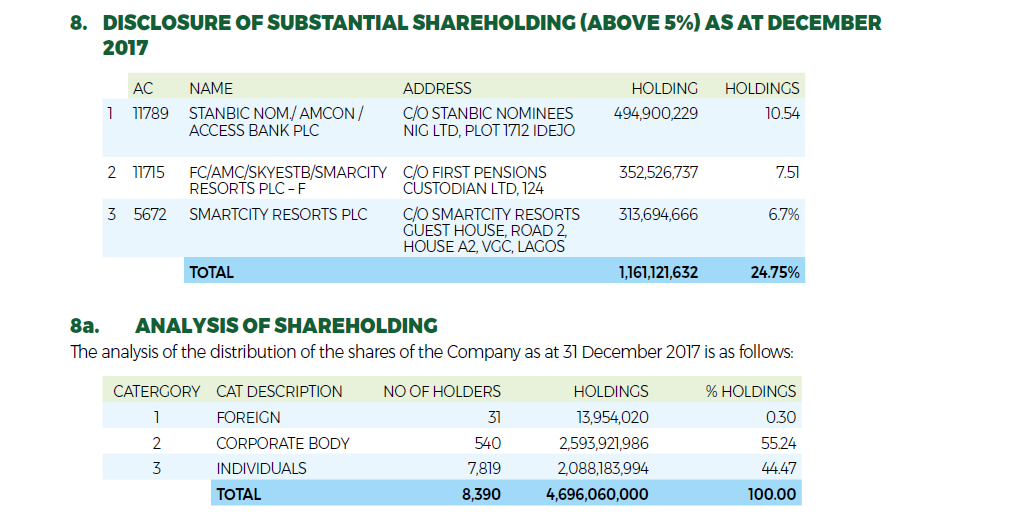

Information about the company’s substantial shareholding structure, as contained in its 2017 full year financial report, has it that some 494,900,229 units of shares belong to Stanbic Nom./AMCON/Access Bank Plc. This makes up about 10.54%.

For more on the company’s substantial shareholding structure, see the picture below:

On the company’s growing competition

Although Chams Plc can always pride itself as one of the foremost companies in Nigeria’s vibrant tech space, it is currently not enjoying any monopoly. This is because so many more companies have emerged on the scene since 1985, offering similar services for which Chams is known, and perhaps even doing it a lot better.

We have the likes of eTranzact, Computer Warehouse Group, Courteville Business Solutions Plc, Cellullant, etc. To some extent, some companies that perform outsourcing services for firms (such as C & I Leasing Plc and others) also pose as competition to Chams.

All of these companies are competing for market share, meaning that Chams really needs to step up its game in order to remain relevant. But has the company been able to do this?

The company still commands a considerable market share especially with government contracts in the area of data security and identity management. However, it has lost ground to the more lucrative enterprise management and tech support to more innovative local companies and more importantly the might of Chinese tech giant Huawei.

You would expect Chams to compete in the area of software development and solutions for utilities such as the telecoms and power sector but Chams seem to be struggling in these growth areas.

Chams heavy reliance on government sponsored projects is perhaps its greatest weakness and needs to change if it wants to compete in the businesses of the future.

A look at the company’s financial report

Unfortunately, Chams Plc has failed to maintain steady growth over the last five years. Both revenue and profit have fluctuated, dropping from N3.4 billion in 2013 to N1.9 billion in 2017. The company also recorded a loss after tax of N1.2 billion in 2017, down from N1.5 billion in the preceding year.

According to a shareholders’ address by the company’s Chairman, as contained in its 2017 financial report, the recorded loss was due to a number of factors such as unfavourable economic conditions, impairment of receivables and investments in subsidiaries to the tune of N1.24 billion. He, however, gave assurance that a lot is being done to turn around the fortunes of the company.

On a final note, it is worth noting that Chams Plc has a lot of potential, thanks to its valuable business model. More so, if its Q1 2018 is anything to go by, it is already on the right path to financial recovery. Revenue grew to N739 million, up from N334 million in Q1 2017. Profit after tax also stood at N119 million, up from N89 million in Q1 2017.