Cutix Plc hit a 5 year high of N3.99 in yesterday’s trading session on the Nigerian Stock Exchange (NSE). The stock has also consistently gained in the last three trading sessions this week. The stock went up by 10% on Monday, another 10% on Tuesday, and appreciated by 9.9% in Wednesday’s session.

Year to date, the stock is up 98.5% and is one of the best performing on the NSE year.

The rally in the company’s share price may be related to its declaration of a dividend of N0.20 per share and a bonus of one new share for every ordinary share held. The company disclosed this in a notice containing boardroom resolutions sent to the NSE

Cutix last gave a bonus issue of two shares for every three held in 2012.

Results for the 12 months ended April 2017 show that revenue increased from N3.6 billion in 2017, to N5 billion in 2018. Profit before tax increased from N420 million in 2017 to N688 million in 2018. Profit after tax also surged from N273 million in 2017 to N447 million in 2018.

Steady performer

Cutix has maintained a consistent increase in revenue and profitability over the past 5 years. Revenue increased from N1.9 billion in 2013 to N5.0 billion in 2018. Profit after tax has also increased from N151 million in 2013 to N447 million in 2018. Asides the 2017 financial year, the company has paid dividends consistently for 25 years between 1989 and 2016.

Implications of the bonus issue

A positive fall out from the bonus issue is that it would enhance the liquidity of the stock as more shares will be available to trade.

On the flip side, earnings per share could take a momentary dive as the shares outstanding will double from 880 million to 1.6 billion. EPS for the financial year ended April 2018 was N0.51. Except the company is able to sharply increase its earnings, EPS for the next financial year could be in the range of N0.25 to N0.30.

This would leave the stock trading at a PE ratio of 16 times earnings at current prices, more than the twice the average PE ratio on the NSE. Cutix is currently trading at a price to earnings ratio of 7.8 times earnings, slightly higher than the average PE on the exchange.

Price Earnings is a ratio used to measure how expensive a stock is.

About the company

Cutix Plc was incorporated on November 4, 1982 as a private limited liability company. The company was initially quoted in the Alternative Securities Exchange Market (ASEM) of the NSE on August 12, 1987. On February 18, 2008, it migrated to the main tier

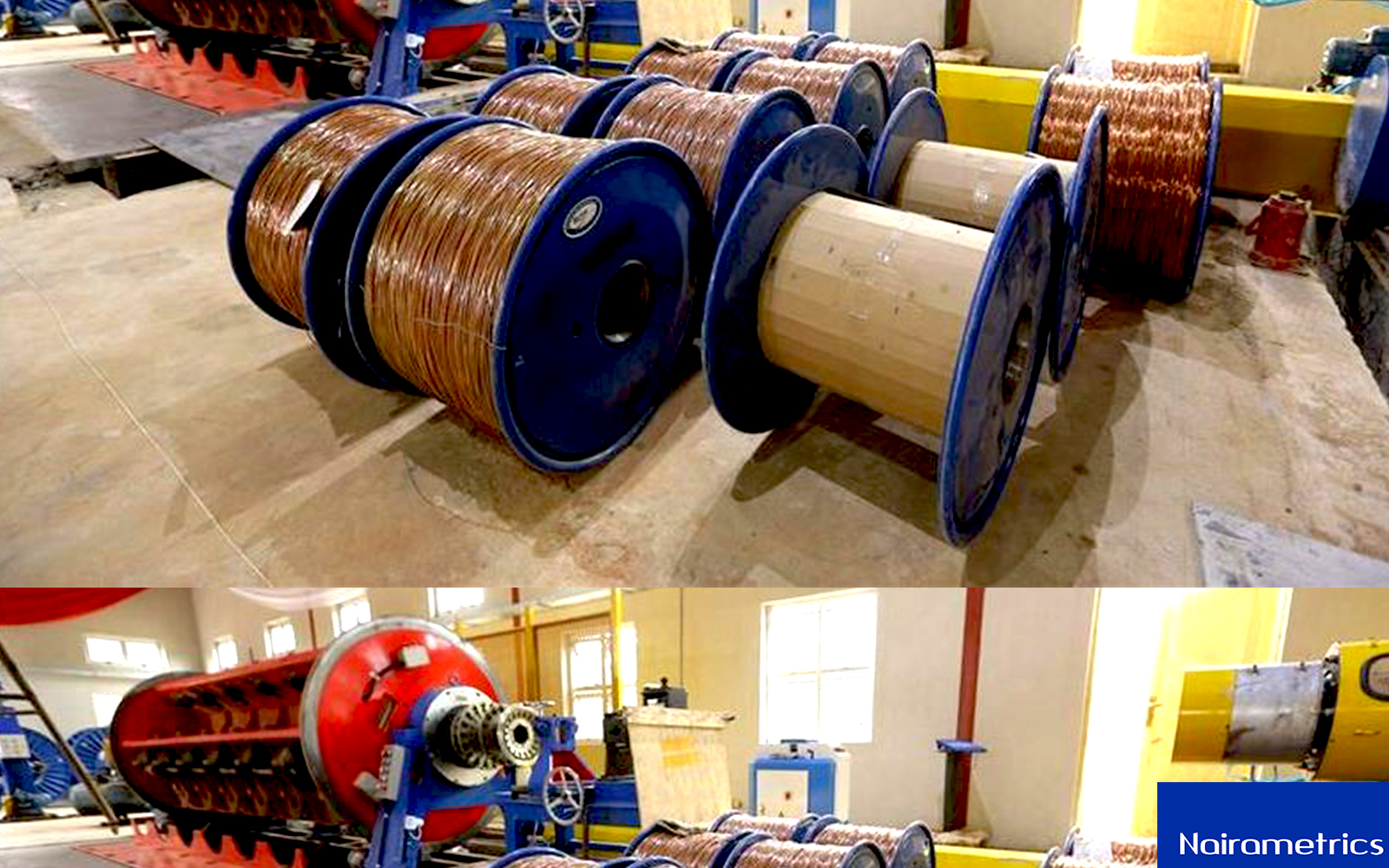

Cutix is into the manufacturing and marketing of electrical, automobile and telecommunication wires, cables and related products.

The PE ratio would not change materially as the price per share will also be marked down after the bonus is paid… So the adjustments to earnings per share and price per share will even themselves out…