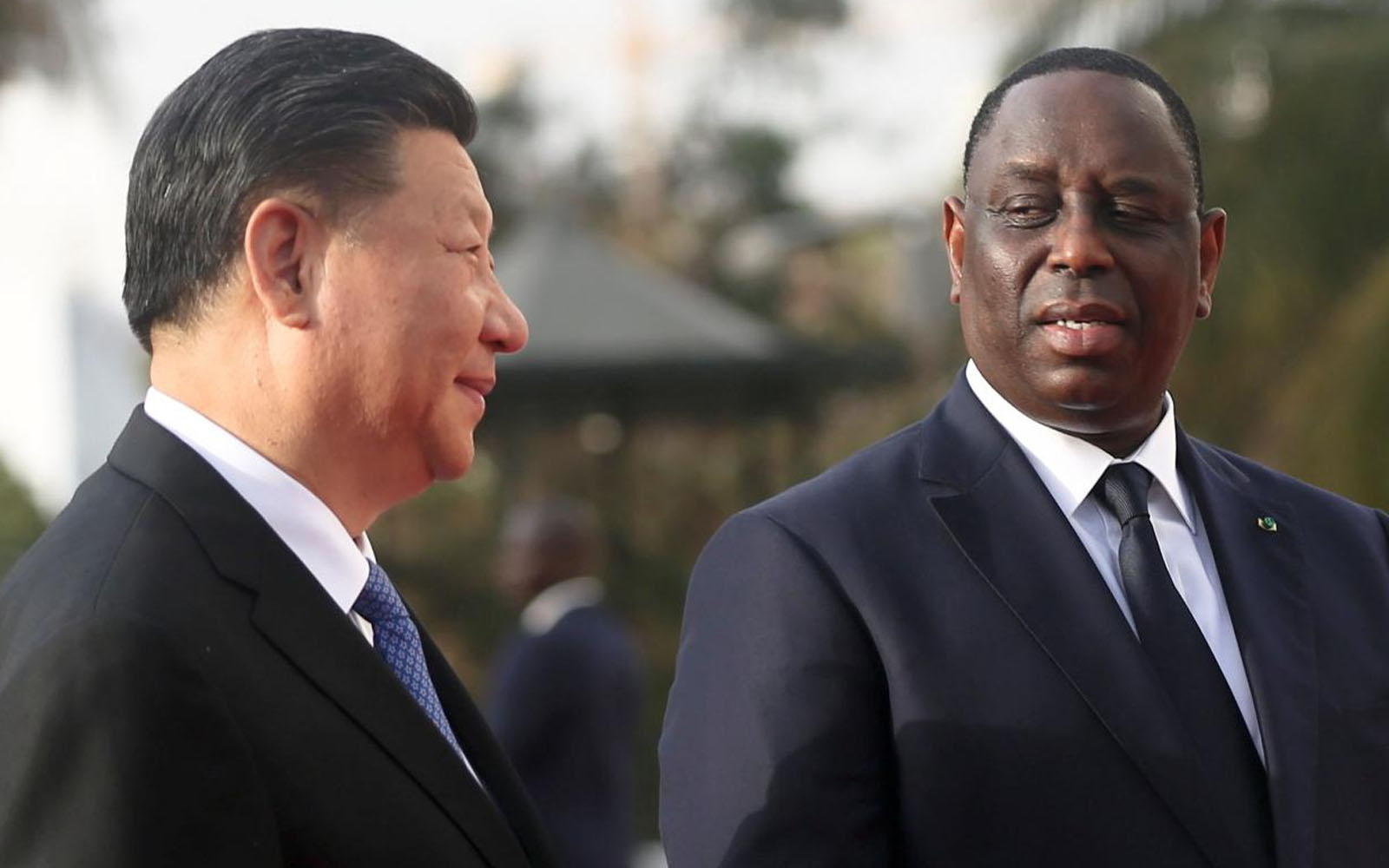

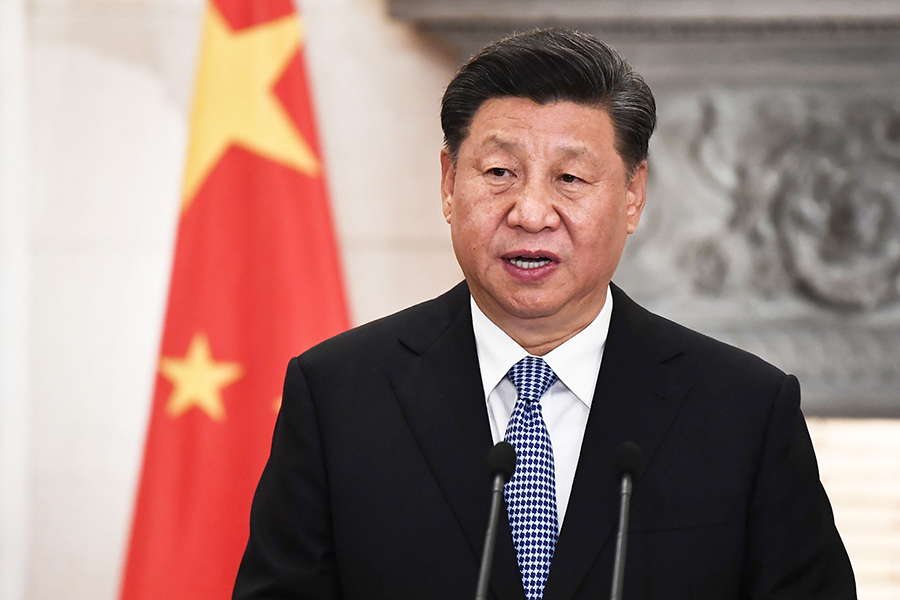

Chinese President, Xi Jinping has on Saturday, arrived the Senegalese capital, Dakar. His visit marks the beginning of a four-nation African visit, seeking deeper military and economic ties. His trade visit will also take him to Rwanda, Mauritius and South Africa; the latter for a summit of BRICS countries: Brazil, Russia, India, China and South Africa. The summit is coming amid the China-United States, billion dollar trade war.

Jinping pledged to strengthen economic ties with Africa – a continent already awash with cheap Chinese loans in exchange for minerals and huge construction projects. Africa, in recent times have witnessed more trade with China, making her Africa’s largest trading partner.

Also, Djibouti this month, launched a China-backed free trade zone that is considered to be the largest in Africa. Earlier this month, China hosted dozens of African military officials for the first China-Africa defense forum, which saw China overtaking the US in arms sales to Africa in recent years.

Jinping’s visit, which is his fourth Africa visit, also showcased China’s sweeping “Belt and Road” initiative that envisages linking Beijing to Africa, Europe and other parts of Asia via a network of ports, railways, power plants and economic zones.

Though, the United States and other critics have warned African nations against compounding Chinese debt, despite the high profile projects such as infrastructure and economic growth for the continent. This they consider, might lead to African nations handing over controlling stakes in strategic assets to China.

According to the China-Africa Research Initiative at Johns Hopkins University, Chinese government, banks and contractors have loaned more than $94 billion to African governments and state-owned companies from 2000 to 2015.

Recall May, 2018, Nairametrics reported a Naira-Yuan swap deal reached by the Nigerian Government and the Chinese Government. The Peoples Bank of China (PBOC) disclosed this in a notice on its website. Governor Godwin Emefiele signed on behalf of the Central Bank of Nigeria (CBN), while Governor Yi Gang signed on behalf of the PBOC. The size of the swap facility is RMB 15 billion/NGN 720 billion. The agreement is valid for three years and can be extended upon mutual consent.

Nairametrics also reported last week, the start of the trade of Yuan for the first time after Nigeria secured a Naira-Yuan currency swap deal. CBN had asked commercial banks to bid for renminbi on Friday. The results, are however, expected to be out by Monday.