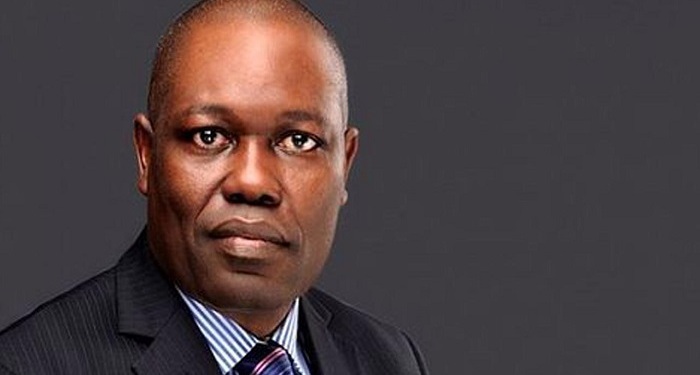

Ecobank Trans International (ETI) Managing Director Ade Adeyemi may have foreclosed the possibility of the bank raising a Eurobond this year, due to a sell-off in emerging markets. He disclosed this while being interviewed by Bloomberg.

“There was no trade war when we started. There were no challenges in Turkey. As per now, we just wait. If we don’t get a window, we do it next year.”

The bank last month appointed Deutsche Bank, Standard Bank and Standard Chartered Bank as Joint Bookrunners for a proposed 5 year USD bond offering.

ETI, in October last year raised $400 million convertible debt. The debt was structured in three tranches, and was taken up by Public Investment Corporation (PIC) of South Africa, Qatar National Bank (QNB) and other parties. Proceeds were used to refinance short-term debt.

Impairments are dropping

Impairments have shown a gradual decline. FY 2017 results show impairments fell from N221 billion in 2016 to N125 billion in 2017.

Results for the first quarter ended March 2018 show impairments dropped slightly from N23.3 billion in 2017 to N20 billion in 2018.

The bank in October last year set up a Special Purpose Vehicle (SPV) to buy up impaired assets held by Ecobank Nigeria.

“Our credit portfolio is not as bad as it used to be. Our intention is to get our cost-income ratio from 60 percent today to 50 percent in the medium term. Once we do that, we will be able to generate a return on equity above 20 percent.”

Cost to income ratio is a measure of how efficient a bank is run. It is calculated by dividing operating expenses by operating income. The lower the ratio, the more efficient the bank is.

Return on equity (ROE) is a measure of profitability that calculates how many Naira of profit a company generates with each dollar of shareholders’ equity.

Increased profits, amidst a drop in impairments, mean the bank could pay a dividend to shareholders at the end of the 2018 financial year. ETI last paid a dividend in 2015.

ETI closed at N20.40 in today’s trading session on the Nigerian Stock Exchange (NSE), down 1.46%. Year to date, the shares are up

The bank this week announced the departure of Charles Kie, Managing Director of Ecobank Nigeria. While no reason was given for his action, Kie last year filed a suit at a Federal High Court seeking to restrain officials of the Nigerian Police from arresting him.

The police had allegedly requested that Kie effect the transfer of $10.5 million from a customer’s account. In addition, there was an attempt to arrest him at the bank’s head office.