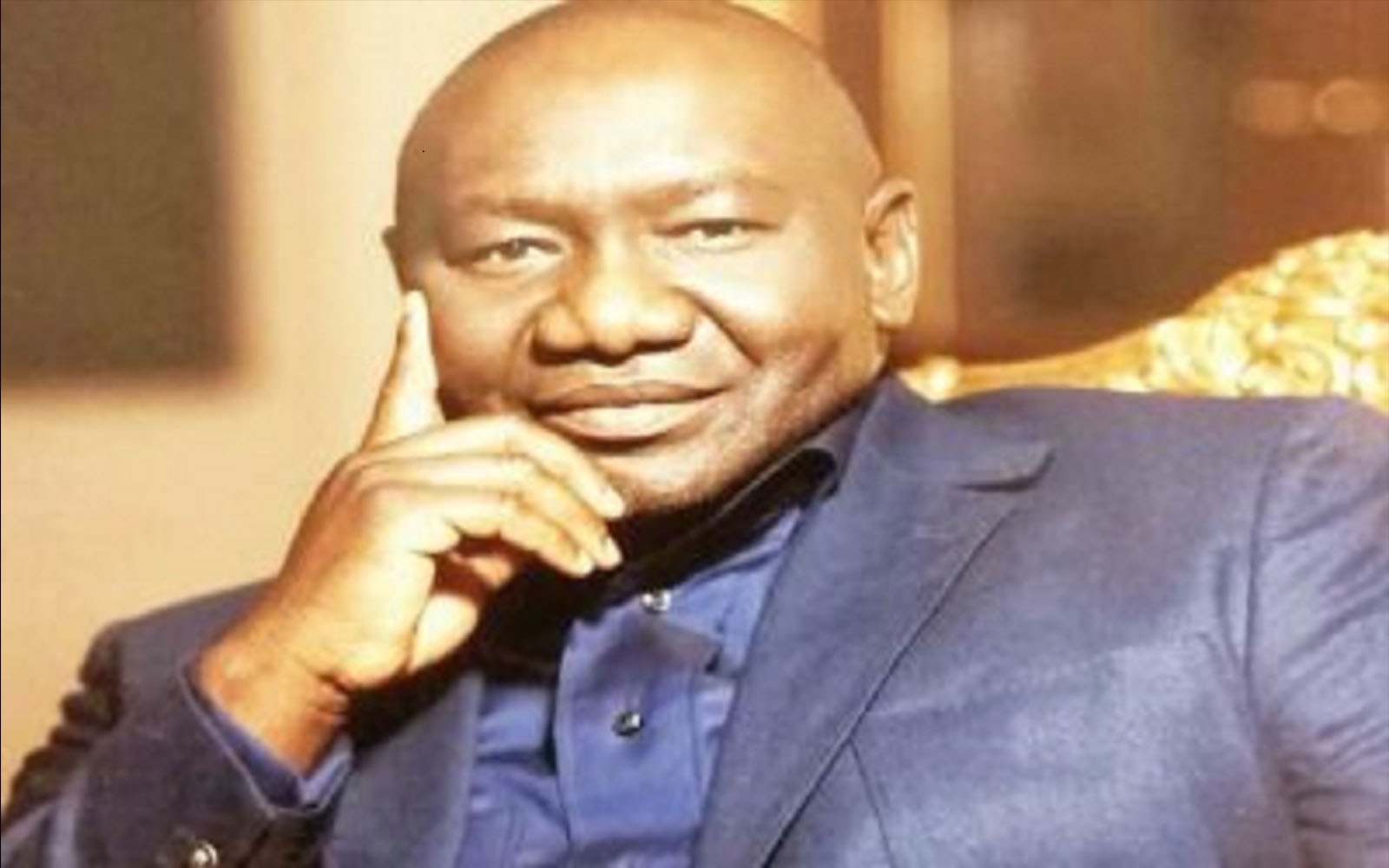

In a landmark ruling on Friday July 6, 2018, the Federal High Court in Abuja, Nigeria has directed the immediate release of two properties located in the United Kingdom belonging to African Billionaire businessman and CEO of the Aiteo Group (www.AiteoGroup.com), Benedict Peters that had been the subject of an Interim Forfeiture Order obtained by the Economic and Financial Crimes Commission (EFCC) without notice to him. By this decision, the court has upheld his case that the properties wholly belonged to him; were unconnected to the former Petroleum Minister, Mrs Diezani Allison-Madueke and were unjustifiably included in a list of properties the anti-graft agency tried to seize.

In suit no FHC/ABJ/CS/228/2016, Benedict Peters and two of his companies, Rosewood Investment limited and Colinwood limited, filed applications before the Honourable Justice Binta Nyako, seeking the discharge of the forfeiture order that she had made in April and June 2016 affecting their properties. The factual summary of the case put before the court was that he is the exclusive and beneficial owner of the following properties: Flat 5, Parkview, 83-86 Prince Albert Road, London; Flat 58 Harley House, Marylebone Road, London and 270-17 street, Unit #4204, Atlanta, Georgia, USA, that were wrongly included in a list of 19 properties in the order as allegedly belonging to the former minister.

In an application argued on his behalf by Chief Wole Olanipekun, a Senior Advocate of Nigeria (SAN), the court was urged to vacate the orders because EFCC’s premise for alleging that the properties belonged to Allison-Madueke was manifestly unfounded and not supported by any shred of evidence. Relying on the contentions that EFCC acted “upon gross misstatements, concealment and misrepresentation of facts,” sought and obtained ex-parte an interim order of forfeiture of the properties, Chief Olanipekun argued that “that the mandatory condition precedent to the grant of the interim forfeiture order was not complied with and due process of law was not followed in obtaining the interim order of forfeiture”. For the applicants, it was further asserted that concealment of accurate, relevant information from the judge when the order was made was fatal to EFCC’s case. The applications were based also on a number of significant legal arguments demonstrating the unsustainability of the order.

In her judgement, the Honourable Justice Nyako referred to a decision of the High Court of the Federal Capital Territory (FCT) handed down by Justice Musa in which Peters was a Defendant and declared that “…a subsisting judgement of a Court of coordinate jurisdiction has found and held inter alia that the property listed as Flat 58 Harley House, Marylebone Road, London, and the property listed as Flat 5, Parkview, 83-86 Prince Albert Road, St John’s Wood, London have been subject of the litigation in the suit before the High Court of the FCT, where a judgement of the Court dated 5th December 2017 was made which orders have declared that, these said properties amongst others having being legitimately acquired by the Defendant, they cannot be forfeited to the government under any circumstances.”

Justice Nyako accordingly directed that “the order of interim forfeiture that was made in this case cannot override or supersede an order of final judgement of a court of coordinate jurisdiction.” The learned judge then ordered that in that event, those properties could not continue to be restrained by the order EFCC had obtained and consequently directed the immediate release of the London properties.

However, with regard to the property in the US, the judge took the view that the property would remain affected by the order until further evidence seemingly in the same mould as that produced to the FCT High Court was placed before the court. The US property was not dealt with in the FCT case.

This latest court ruling follows other judgements vindicating Mr Peters from the various allegations that have been very publicly aired by EFCC. On December 5, 2017, the High Court sitting in the Federal Capital Territory declared that earnings and assets accruing to him were acquired legally through legitimate sources. Also, on March 21, 2018, an FCT High Court voided EFCC’s unilateral declaration of him as ‘Wanted,’ describing it as ultra vires, unconstitutional and a flagrant violation of his Fundamental rights. On 7 December 2017, another FCT High Court, in a suit brought against him, declared that a donation of $60m he made to a political party was a legitimate donation and did not violate any provisions of the laws of Nigeria.

His belief in the primacy of the Rule of Law and inviolability of the judicial process continues to be justified by a series of judicial verdicts and pronouncements supporting his position. These outcomes have been achieved in various cases in which he has been represented by a robust legal team comprising some of the foremost advocates in the country. The team, led by Chief Wole Olanipekun SAN, a former leader of the Nigeria Bar, comprises senior lawyers Kanu Agabi SAN and Chief Akin Olujinmi, SAN, both former Attorneys General and Ministers of Justice of the Federation, renowned Constitutional and Human Rights Lawyer, Chief Mike Ozekhome SAN, Messrs Paul Usoro, SAN, Rotimi Oguneso SAN and A U Mustapha, SAN. All Senior Advocates (the equivalents of Queen’s Counsel in the United Kingdom) are distinguished practitioners at the apex of legal practice in Nigeria. Others lawyers include Ebenezer Obeya, Chief Andrew Oru, Mrs Boma Alabi, Messrs Chidi Nobis-Elendu, Emeka Ozoani and Joseph Nwatu.

Olanipekun, who is described as Nigeria’s Avant-Garde lawyer, is referred to as of Nigeria’s leading trial lawyer. Kanu Agabi, an accomplished litigator, served Nigeria twice as Attorney General as did Akin Olujinmi whose core practice is also litigation. Mike Ozekhome’s reputation as one of Nigeria’s foremost Constitutional Law and Human Rights advocates draws from a lifelong career of fighting oppression and injustice through courts and social advocacy. Paul Usoro is a nationally acclaimed litigation and transaction expert whose core areas span the gamut of commercial law practice. Excellent all-rounders Oguneso (of the stable of Abdullah Ibrahim, SAN, also a former Attorney General of the Federation) and Mustapha make up the team of Senior Advocates. Others in the team include Security law expert Ebenezer Obeya, dual qualified and former President of the Commonwealth Lawyers Association Boma Alabi as well as the combative Andrew Oru.