T-bill Yields Tick Higher Despite Huge OMO Inflows

OPEC inches towards oil output deal ahead of key meeting

Bonds

Bond yields declined slightly by c.7bps in today’s session, with some cherry-picking observed especially on the 2036 and 2037 bonds. This came on the back of a slowdown in offshore selling witnessed in the previous session. We expect a further decline in yields tomorrow, as they are relatively attractive at current levels. This is however barring a renewed offshore selloff.

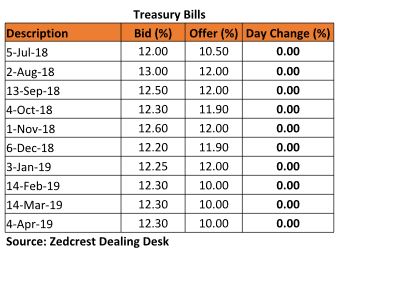

Treasury Bills

The T-bills market traded on a relatively flat note, with yields inching slightly higher by c.6bps on average. This came as market players were looking to preserve some liquidity in anticipation of funding for a retail SMIS by the CBN tomorrow. We expect yields to remain slightly pressured due to the anticipated FX funding. The CBN did not conduct an OMO auction which was much anticipated due to the c.N380bn OMO T-bills maturities. We expect that this may on the reverse side, fuel some client demand in absence of an OMO T-bill auction tomorrow.

Money Market

The OBB and OVN rates crashed significantly by c.10pct to 3.00% and 3.75%, as system liquidity was significantly bolstered by inflows from OMO T-bill maturities and Net PMA repayments (c.N400bn). System Liquidity is consequently estimated to close at c.480bn positive, from c.N200bn in the previous session. We however expect rates to trend higher tomorrow due to anticipated funding for retail FX sales by the CBN.

FX Market

The Interbank rate appreciated by 0.02% to N305.80/$ from its previous rate of N305.85/$. The I&E FX rate also appreciated marginally by 0.01% to N361.14/$. In the parallel market, cash rates remained stable at N360.00/$, while the transfer market rate fell back by 20k to N364.50/$.

Eurobonds

The NGERIA Sovereigns traded on a relatively flat note with not much seen in the way of flows on the bonds. Yields consequently remained relatively unchanged from their previous day’s levels, with the most action seen on the shorter end of the curve (21s – 23s) which compressed marginally by 2bps on average.

The NGERIA Corps were slightly more active, with investors still selling off on the FBNNL 20s (+34bps) and ECOTRA 21s (+8bps). We however witnessed slight buying interests on the Zenith 22s (-11bps) and DIAMBK 19s (-2bps).