- Market players Stay Cautious despite Projected Decline in Inflation

- Nigeria’s inflation slows for 16th straight month to 11.61% in May – NBS

- Buhari to sign 2018 Budget Next week – Adesina

- US Fed Hikes rates by 0.25%

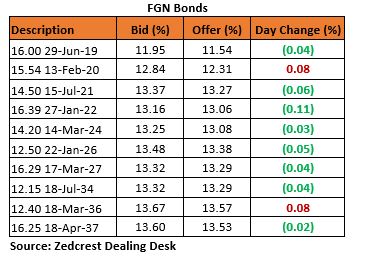

Bonds

The Bond market remained relatively stable with yields compressing slightly by c.2bps, following some client demand on the short to medium end of the curve. This came as market players anticipated a further decline in the May inflation result which trended lower by 87bps M/M to 11.61%. We expect yields to remain relatively stable at these levels with some sell pressure still witnessed on the longer end of the curve in recent sessions. We also note that offshores are still net sellers of FGN bonds in anticipation of a further hike in the US Fed fund rates which is expected to further dampen sentiments in the EM space.

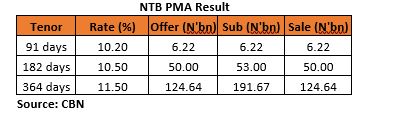

Treasury Bills

The T-bills market remained relatively flat, with yields compressing slightly by c.2bps. The PMA conducted by the CBN was moderately subscribed at an average of 1.38X bid to cover. Rates however cleared slightly higher at 10.20, 10.50 and 11.50 on the 91, 182 and 364-day respectively due to the increased volumes on offer. We expect yields to tick slightly higher tomorrow, as the CBN is expected to intervene via an OMO T-bill auction to mop up excess liquidity from expected OMO maturities.

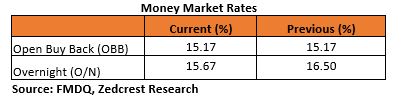

Money Market

The OBB and OVN rates remained relatively unchanged at 15.17% and 15.67% respectively, as system liquidity declined slightly to c.N130bn long. We expect rates to decline slightly tomorrow, due to expected inflows from c.N244bn OMO T-bill maturities. This should however be moderated by an expected OMO auction sale by the CBN.

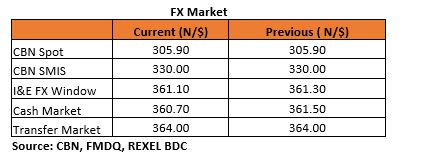

FX Market

The Interbank rate remained stable at its previous rate of N305.90/$. The I&E FX rate appreciated slightly by 0.06% to N361.10/$. In the parallel market, cash rates depreciated further by 80k to N360.70/$, while the transfer market rate remained stable at N364.00/$.

Eurobonds:

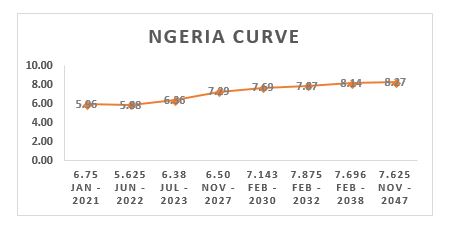

The NGERIA Sovereigns remained significantly bearish, as investors continued selling off across the curve ahead of the much anticipated hike in the Fed funds rate. Yields consequently rose further by c.10bps on average, with the most selloff seen on the 2032s which was down by as much as 1pt.

The NGERIA Corps also remained bearish across all traced tickers, with the most selloff witnessed on the Access 21s Snr and FIBAN 22s which fell by as much as -0.65pt (+21bps). Investors also sold off on the UBANL 22s (-0.50pt), and Access 21s Sub (-0.50pt).