A series of unfortunate events …as sell-offs are sustained

The heightened uncertainty in the Nigerian financial markets in the past month, resulted in a series of unfortunate events. Sell-offs in the equities market caused stock prices to slid towards their year-lows; waning demand drove bond yields higher on longer tenors.

In the midst of this, the CBN intensified measures to stabilise the foreign exchange market on the back of higher global oil prices. Interestingly, these events were not unique to our economy as capital flights were witnessed in other frontier and emerging markets.

An analysis of global equity indices reveals a steeper downward slope in both frontier and emerging markets’ equity indices in the past month. The declines recorded were beyond the stock market correction in February, where global markets as measured by the S&P Global BMI index, shed about USD5.2trillion.

Is the impact of the US monetary policy overstated?

On the back of the heightened selling pressures, the Nigerian All-Share index decline by 7.67% in the month of May. The consumer goods sector bore the greatest brunt of the rout as indicated by the NSEFBT10 index, which shed substantially by 11.38% in the same period.

It is safe to say that investors in the insurance sector shed the least tears as the return on NSEINS10-2.58% index moderated the least.

Despite the US Fed’s recent warnings against overstating the influence of U.S. monetary policy on global financial markets, we expect the anticipation of further rate hikes in the United States to exacerbate the current dampened investor confidence in this region.

In contradiction to the general notion that investing outside developed markets are generally riskier, we are of the opinion that investing in frontier and emerging markets reduce risks via a more diversified portfolio. We however expect investors to tilt their portfolios in favour of higher US yields, over the gains of portfolio diversification.

Bargain hunting, a ray of hope.

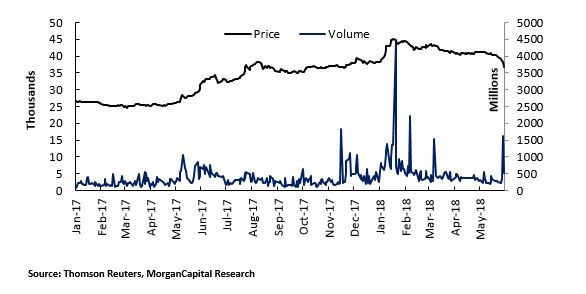

The fear of missing out (FOMO) following the massive gains in 2017 caused investors to troop in to the Nigerian bourse in the beginning of the year. However, selling pressures in frontier and emerging markets, political tensions from the upcoming elections and slower growth in macroeconomic variables have caused the year to date return on the NSEASI to settle in the negative region at -3.73% at the close of trades on June 1, 2018, from as high as about +17.00% earlier in the year.

In line with this, stocks like GUARANTY and NB have seen their year to date return pare to -5.15% and -23.65% respectively. We are of the opinion that the current bearish trend creates an opportunity for investors to buy the dip on fundamentally justified counters.

Investment tip …Be guided by your investment objectives

Historically, it has been proven that investments in stocks with sound fundamentals pay off in the long run, through stock price appreciation.

This is due to the “smoothening-out” of short-term volatility over a longer investment horizon. However, for more active investors, short-term volatility increases both the potential for upsides (gains) and downsides (losses).

This poses the need to trade cautiously, and monitor market sentiments with the aid of technical analysis.

Contact Morgan Capital for more information.

Email: info@morgancapitalgroup.com

www.morgancapitalgroup.com

.gif)