Bellwether

Market breadth advances to 0.96x

Daily Market Summary: 4 NSE sector indices closing underwater(Opens in a new browser tab)

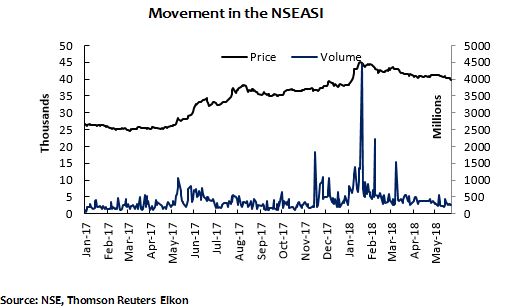

- The NSEASI-1.08% closed in the red, despite a fleeting stay in positive territories today.

- Year to date return on the bourse slided to 0.95%.

- A total of 342.05 million (+53.86%) shares worth NGN4.74 billion (+188.46%), were exchanged in 5,057 (+13.36%) deals.

- HMARKINS+6.25% closed as the best performing counter yet again, while profit-takers saw IKEJAHOTEL -7.04% close as top laggard in the session.

- An analysis of all NSE sector indices reveals an improvement in market sentiment, barring the banking, consumer, and industrial goods space which saw gains stifled by the price shedding on heavyweights.

Slow down in Agric GDP Growth rate suggests Buhari’s Agro-policy is failing (Opens in a new browser tab)

Why stocks are down

- Based on our analysis of trades today, we attribute the extended bearish close to the losses recorded on some bellwether counters like DANGCEM-1.02%, NESTLE-3.75%, NB-4.35% andZENITHBANK-1.92%.

CSCS Plc will pay a final dividend of ₦3.5 billion(Opens in a new browser tab)

Insurance sector:NSEINS10 index gains 99bps

The bulls regained their charge on a number of counters such as; HMARKINS+6.25%, MANSARD+4.17% and LINKASSURE+3.80%.

Angola’s oil money lures Sahara Group(Opens in a new browser tab)

The sector recorded the greatest buying pressure, with its index advancing by 0.99%.

The Year to date return on the NSEINS10 index therefore advanced to 1.61%.

Contact Morgan Capital for more information.

Email: info@morgancapitalgroup.com

www.morgancapitalgroup.com