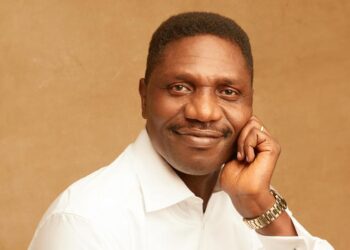

The Managing Director of Asset Management Corporation of Nigeria (AMCON), Mr. Ahmed Kuru, has commended the directive of the Central Bank of Nigeria (CBN) compelling commercial banks to lend the real sector for economic growth.

Kuru stated this at the Institute of Directors (IoD) 2018 luncheon held in Lagos.

He also noted that lending to the sector would help drive investment and growth, noting that the key determinants of growth in any economy are good governance and human capital.

Recall that the Central Bank Governor, Godwin Emefiele during the last Monetary Policy Committee meeting disclosed that the apex bank was working on a policy that would penalize banks with excess liquidity in a bid to encourage lending to the real sector.

The real sector comprises agriculture, industry, building and construction, wholesale and retail and the services sectors.

The real estate industry which is the fifth largest contributor to the Nigerian economy and a potential goldmine for investors; but as the Nigerian economy grew, the real estate industry’s contribution to GDP dwindled.

Figures from the National Bureau of Statistics (NBS) shows the real estate sector is still in recession. The Q1 2018 report shows a -9.40% contribution to the GDP. The sector ended 2017 with a -5.92% contribution to the country’s GDP; a significant drop from the -3.1% recorded in the 1st quarter 2017.

Experts have attributed this to the restrictions placed on the availability of foreign exchange that affected the construction industry, which is heavily import based, and the unstable economic climate which has affected the general willingness to invest in the country’s real estate sector.

The 2016 economic recession impacted negatively on company’s bottom line in the real estate and construction sector.

Julius Berger, Nigeria’s largest construction company by market value, saw its earnings reduced as the country suffered its worst economic contraction in 25 years in 2016.

The company posts a ₦2.4 billion loss in 2016, however, the company made a profit of ₦2.57 billion in 2017, and revenue stayed at ₦141.9 billion. Also, results for the first quarter ended March 2018 show the company reported revenue of ₦35.32 billion for the period ended March 2018 compared to ₦34.15 billion reported for the period ended March 2017.