Nigerian pension fund assets grew by about 2% in March 2018 to almost N8 trillion, according to data released by the Pension Commission of Nigeria, PENCOM.

The value, which stood at N7.8 trillion by the end of February 2018, ended the month of March at N7.94 trillion, increasing by about N149 billion.

A cursory analysis by Quantitative Financial Analytics shows that the increase arose from investment gains and contributions. The analysis indicates that about N322 billion was contributed in, while N172 billion was withdrawn from the pool leaving the funds with a net positive inflow of N149 billion.

According to the analysts, RSA and Retiree pension funds generated a median return of 0.59 % and 1.05% respectively in March while the Gratuity funds, managed by PAL Pension fund, returned 1.19% which boosted member contributions to achieve the 2% increase.

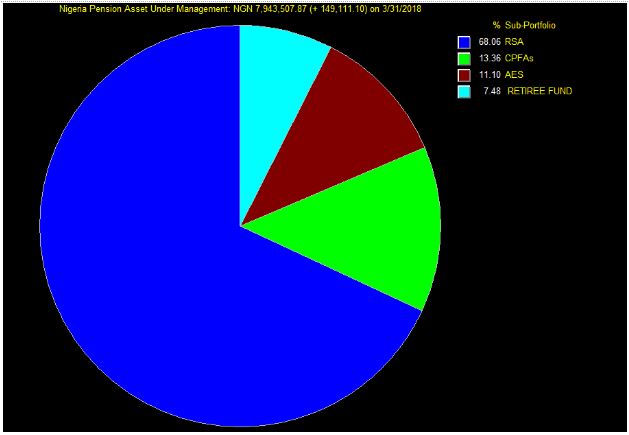

Retirement Savings Account (RSA) still remains the largest category in the pension fund industry with 68.06% share down from 68.09 % in February, followed by Closed Pension Fund Administrators (CPFA) 13.36%, up from 13.2% in February.

AES’ share of pension fund assets remained unchanged at 11.10% between February and March, while Retiree Fund assets share decreased from 7.61% to 7.48%.

The data further shows that N3.86 trillion or 48.61% of pension funds is invested in Government bonds (down from N3.97 trillion in February) while 20.89% or N1.66 trillion (up from N1.46 trillion in February) is invested in Treasury bills.

So, in the month of March 2018, pension funds’ investment in Government bonds decreased by about N122 billion while investments in Treasury bills inched up by about N199 billion representing a decrease of 2.83% and an increase of 13.67% respectively.

Other assets that got enhanced allocation include corporate debt securities (25% increase), cash and other assets, (12.69% increase), open and closed mutual funds, (5.72% increase) and Real Estate properties (3.98% increase).

State Government Bonds, Banks, Supranational Bonds, Green Bonds and Domestic ordinary shares also saw their allocation increase by 3.84%, 2.07%, 1.99%, 1.08% and .07% respectively.

On the down side, pension fund managers divested greatly from foreign ordinary shares as that asset class decreased by 42.44% from N105 billion as at the end of February, to N60.8 billion by March ending.

This may not be unconnected with the volatility in the foreign stock markets arising from president Trump’s trade war with China and other US trading partners, the unilateral pull-out of the US from the Paris Agreement on Climate change, as well as his tinkering with the North American Free Trade Agreement (NAFTA)

Private Equity investments also got shunned by pension fund managers as they reduced their exposure to that asset type by 18.29%. Surprisingly, their new-found love, Sukuk Bonds also saw a reduction in asset allocation of 5.64% from N58 to N55 billion. Agency Bonds, REITs and Infrastructure funds also suffered some reduction in asset allocation.

In spite of the decreases, the growth in pension assets in Q1 2018, from N7.5 trillion to N7.9 trillion representing 5.7%, exceeds its growth in the corresponding quarter of 2017. In Q1 2017, the asset grew from N6.1 trillion to N6.4 trillion, representing an increase of 4.12%.

This underscores the fact that pension funds performed better in Q1 2018, and that more and more companies are becoming more compliant in their pension contribution remittances.

Need for Change and Innovation

The performance and increases in pension assets in Nigeria is good news for contributors as this increases their hopes for peaceful retirements. Not only has the PenCom Act of 2014 introduced transparency into the system, it has also broadened and diversified pension investments.

For those who still remember when it was the National Provident Fund, they will remember that compliance was not easy then, while transparency was almost non-existent as contributors did not know where and what types of assets their contributions were invested in, not to talk about whether such investments made gains or not.

There are still some modifications that may need to be introduced to make pension funds more appealing to contributors. Contributors should be at liberty to choose what assets to allocate their contributions to, as it is done in more advanced markets like the 401K investments in the US.

In that case, the pension fund investments will then be aligned to the risk appetites of contributors such that those who are close to retirement can choose to invest more into Government bonds and Treasury bills while the younger ones may choose to invest in riskier but growth-oriented securities like equities.

Fund managers should come up with the so-called target date funds (TDF) which are funds that are designed in such a way that the asset mix becomes more conservative as the target date or retirement date approaches.