A lot of us are fans of GT Bank and admire them for their consistency in delivering returns to shareholders while going on a remarkable run of efficiency.

The bank is currently the most capitalized in the Nigeria even though it’s not the most in terms of equity, deposits or even total assets.

But beyond Nigeria is Guaranty Trust Bank really the best out there, at least, in the developing markets? This analysis from Stanbic IBTC (one of our favorite Newsletters, which you should also subscribe to) strongly believes so.

See below;

I am sure you are probably thinking – Dude, this is BOLD, but it is bold with cause because history and numbers tell the story so it is quite easy to stick my neck out for this call. This is 1 of 2 or 3 emails to articulate my views so I do not bore you with an incredibly long email. And YES, I still think the stock deserves to trade at 3x Book with its developing market peers. It is okay not to agree with me and I am more than happy to banter about that

There is that argument that a bank with consistent financial performance like GTBank should be valued using P/E not P/B

Even Warren Buffet (2013) said it

“A bank that earns 1.3% or 1.4% on assets is going to end up selling above tangible book value. If it’s earning 0.6% or 0.5% on asset it’s not going to sell [above book value].Book value is not key to valuing banks. Earnings are key to valuing banks….You’ve got banks like Wells Fargo and USB that earn very high returns on assets, and they [sell]at a good price to tangible book.You’ve got other banks … that are earning lower returns on tangible assets, and they are going to sell –they’re going to sell [for less].”

At the end of this note, we should be able to showcase GTB as one of the highest quality bank in Frontier and emerging markets and trades at a discount to Frontier and EM Peers.

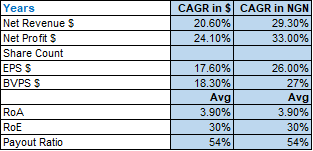

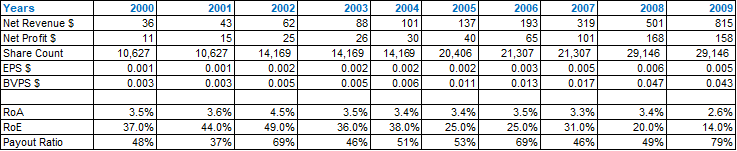

In US Dollars Terms (refer to the table below), GTBank has delivered

- 17.6% EPS CAGR since 2000 in USD

- 18.3% book value per share CAGR since 2000 in USD

- This was achieved while paying out 54% of earnings as dividends

- Average ROA and ROE since 2000 of 3.9% and 30%

- Pre Tax Average RoE of 44%

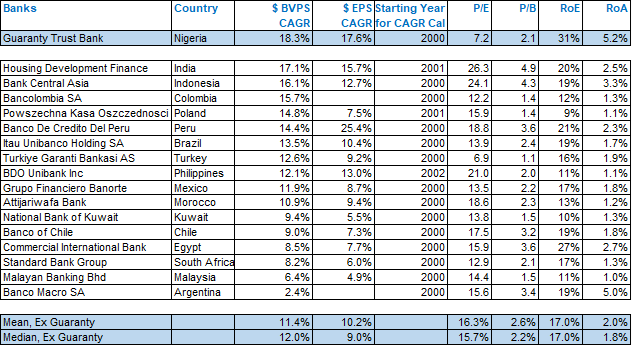

On every metric that matters, GTB’s performance has been superior to that of very well-regarded EM banks such as Commercial International Bank Egypt, Bank Central Asia Indonesia, and HDFC Limited India. While those banks trade at 16-26x trailing P/E, GTB is available at the bargain price of 7x trailing P/E which is almost criminal. Since 2013, USD share price has not performed well due severe depreciation in the Naira.

CAGR (Period 2000 – 2017 in Dollars and Naira Terms)

GTBank has arguably had the best financial performance within our sample of EM and FM Banks, however it trades at a deep discount to them all. Out of the international peer group, GTB has had the single highest USD book value per share growth since 2000, and second highest EPS growth. RoA is highest in the group at 5.2% and almost triple the median of 1.8%.It defies fundamental justification for this bank to trade at 7.2x, close to lowest in the group and less than half the median trailing PE multiple of 15.7x

Let’s bring it home!!!

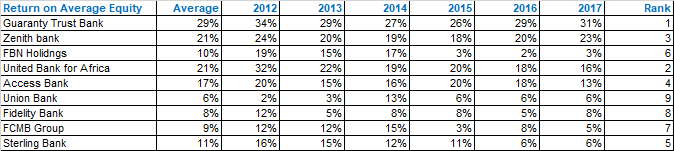

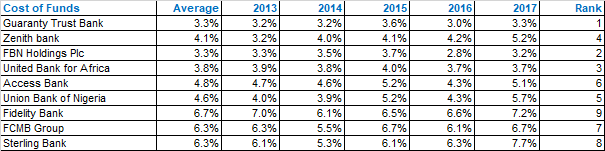

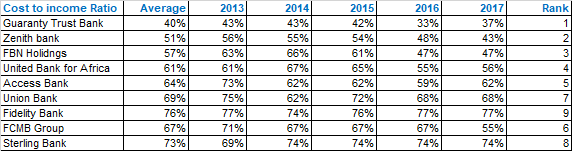

Let us see how GTB has performed relative to its peers in the last 6 years. GTB has delivered the best RoE and RoA in its local market

GTBank – Under promised and over delivered, we get the trick!!!

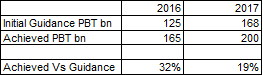

At the start of 2016, GTB provided guidance for pretax income to be NGN 125 billion. GTB actually achieved NGN 165billion. At the start of 2017, GTB provided guidance for pretax income to be NGN 168 billion. GTB actually achieved NGN 200 billion.

GTB has provided initial guidance for 2018 PBT to be NGN 205 billion. If GTB outperforms its guidance by 26%— as it did from 2016-2017—then the 2018 forward PE ratio is 5.6x. GTB in its conference call explicitly stated that the profit guidance for 2018 does not include any revaluation gains. Yet GTB’s books are currently marked at 331, while the real Naira rate is ~360. GTB is substantially long dollars to the tune of $600mn on my estimates and benefits from Naira devaluation. Hence this is a clear source of upside to 2018 guidance if banks decide to mark their books at 360 which is what I believe they should be doing, who is going to take that plunge first???

GTB also explicitly said it expects write backs on a handful loans in 2018, we note that 2018 guidance does not include any write backs. This is another clear source of upside to 2018 guidance.