What took so long and what next?

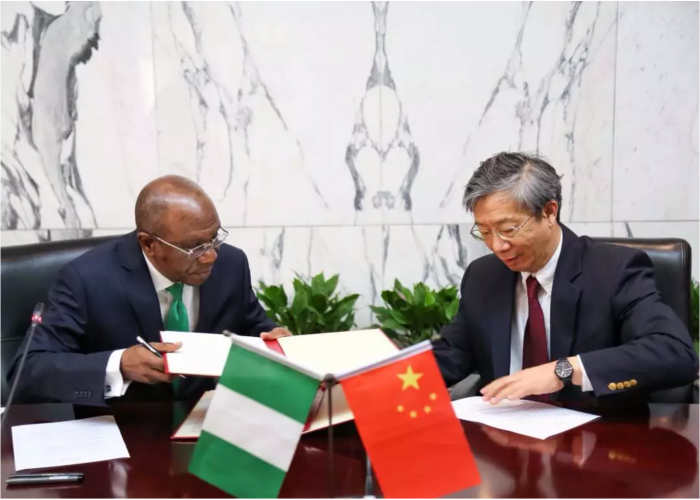

Nigeria first announced that it had signed a bilateral currency swap agreement with China in early April 2016. More than two years later, the deal was finally made official in Beijing on Friday 27th April.

Mind The Trump

What took so long? As always it was a number of things. But first an aside – even though the deal was signed last week, it was only announced today by the PBoC and Nigeria’s Central Bank.

This was because Nigeria managed to convince the Chinese to hold off on announcing the deal until after President Buhari had met with President Trump in Washington on Monday, out of an abundance of caution and deference to the unpredictability of the American president. For a deal that took so long to get done, it would have been most unfortunate if it had been torpedoed by one of Mr. Trump’s tweets.

As to the reasons for the delay, the trivial reason was translating documents back and forth from Mandarin to English – the Central Bank does not appear to have any Mandarin speakers or experts in its ranks. This process thus took much longer than it should have given that all changes had to be approved by China’s State Council.

Read: Nigeria/China Swap Deal explained by Feyi Fawehinmi

There Is Only One China

But more seriously, the agreement got caught up in the minefield of Chinese geopolitics as regards how it views Taiwan in particular and the One-China policy in general. For years, Nigeria had carried on a relationship with Taiwan that more or less recognised it as a country – even referring to it as ‘Republic of Taiwan’ in official documents. Taiwan was also allowed to run a trade mission out of the capital Abuja, which functioned as an embassy in all but name.

Following the election of Tsai Ing-wen as President of Taiwan in 2016 (who refused to ‘appropriately’ recognise the ‘1992 consensus’), things turned frosty between both countries. China thus began to use its leverage across the world to, among other things, bully a number of countries in Africa and the Caribbean into derecognising Taiwan as a country. Nigeria invariably got caught up in this and a visit to Nigeria by China’s foreign minister, Wang Yi, in January 2017 effectively put the country on the spot.

To Taiwan’s fury, Nigeria ordered it to move its trade mission out of Abuja immediately. It also directed all government agencies to immediately cease referring to the country as ‘Republic of Taiwan’. At a joint press conference after their meeting in Abuja during the visit, Geoffrey Onyeama, Nigeria’s foreign minister, affirmed that Nigeria recognised ‘the People’s Republic of China and the One-China Policy’. He went on to add that ‘Taiwan will stop enjoying any privileges because it is not a country that is recognised under international law.’ Only after all these did the Chinese agree to open talks on the swap deal again.

Getting Down To It

So what next? There are still a few loose ends to tidy up before the deal is operationalised. For one, only four Nigerian banks have offices in China which is a requirement for them to act as clearing houses – Stanbic, Standard Chartered, Zenith Bank and First Bank. But more importantly, the PBoC insists that for any bank to access its clearing house, it must have a balance sheet of at least US$20 billion. While Stanbic and Standard Chartered, by virtue of being an international banks, comfortably clear this hurdle, Zenith and First Bank just fall short. The Central Bank would like more than two banks to have access so it is not yet clear how this circle will be squared. One option will be for the Central Bank itself to act as a clearing bank but it does not appear to want to go down this route.

There is also the small matter of both central banks publicising the deals and convincing Nigerian businesses to pay their Chinese counterparts in Renminbi and the for the Chinese to accept it as opposed to the US dollar. Nigeria’s Central Bank also thinks it will need to design a new ‘Form R’ as the current Form M used for dollar applications is unlikely to serve the new purpose.

30 Percent, Maybe

As to the main benefits of the deal – China is by some distance Nigeria’s biggest trading partner with around 30 percent of all current foreign exchange demand relating to trade with the country. For context, the next biggest source of demand is for trade with India which accounts for only about 5 percent of demand. Thus, in a best case scenario, 30 percent of current dollar demand could well be diverted to Renminbi.

It is not always easy to credit Nigeria’s Central Bank governor, Godwin Emefiele, but he got there in the end on this one and continues his recent run of good fortune.

All’s well that ends well.

This article was published with permission from Faye & Fraser, a newsletter for investors, analysts and media organisations who want to better understand Nigeria’s often byzantine political economy. Subscribe here

Thanks for sharing, Feyi. Nice article.